Buyer's Guide: Best Restaurant Equipment Financing for 2025

Share

Why Smart Financing is Key to Your Restaurant's Success

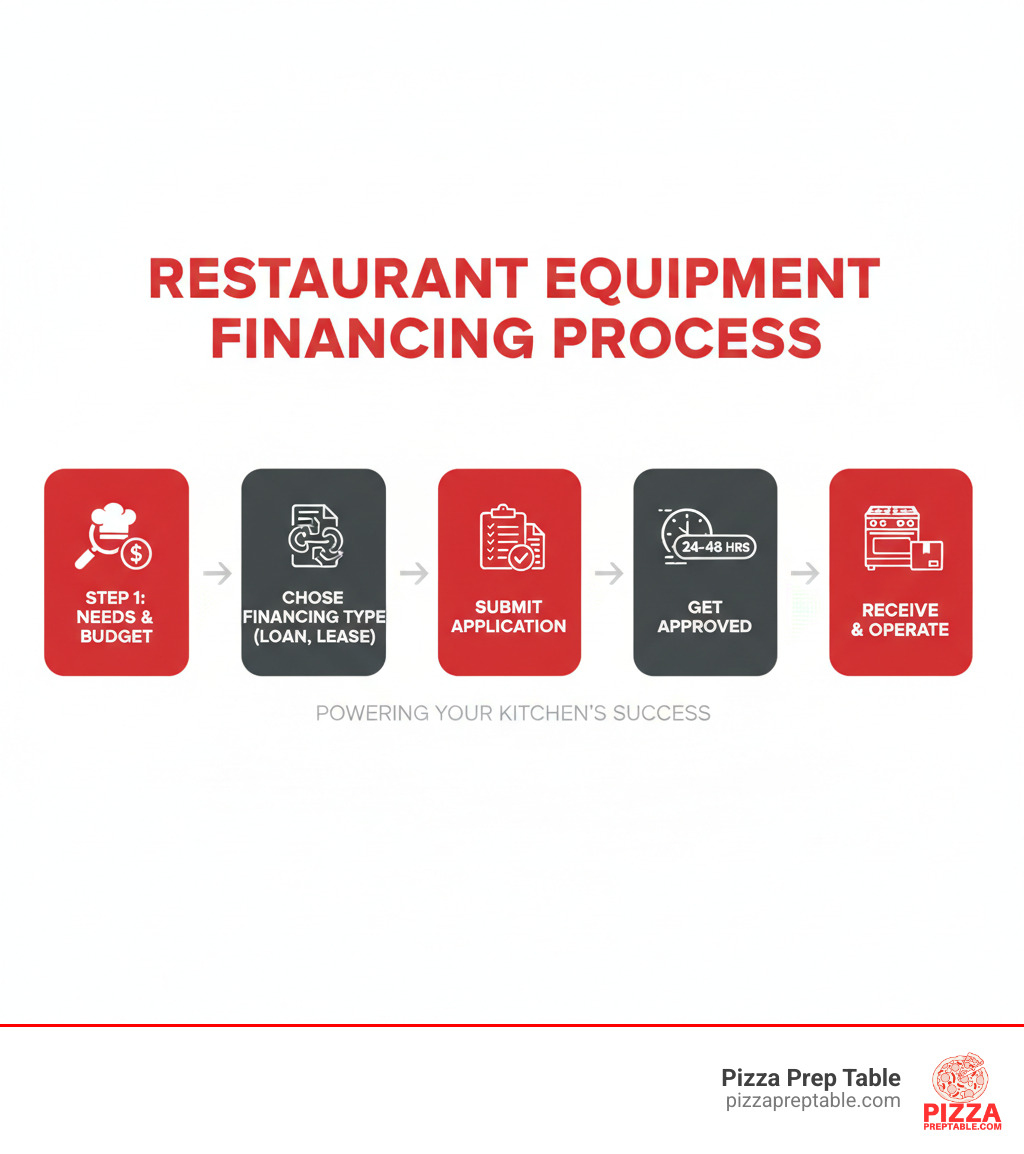

Restaurant equipment financing helps food service businesses acquire essential kitchen equipment through loans or leases without paying the full cost upfront.

Quick Answer for Restaurant Equipment Financing:

- Equipment Loans: Borrow money to buy equipment, using it as collateral

- Equipment Leasing: Rent equipment with options to buy, upgrade, or return

- Vendor Financing: Get funding directly from equipment suppliers

- Approval Time: Often 24-48 hours with alternative lenders

- Credit Requirements: Options available for startups and businesses with fair credit

- Benefits: Preserve cash flow, get tax deductions, and scale operations faster

Starting or expanding a restaurant is expensive, with the average commercial kitchen costing $40,000 to $200,000. This creates a major challenge for pizzeria owners and restaurant managers: how do you get quality equipment without draining your cash reserves?

The solution is strategic financing. Instead of paying upfront, you preserve working capital for daily operations, inventory, and unexpected expenses. Successful operators know that smart financing is often the difference between thriving and barely surviving.

Equipment financing lets you spread costs over time while generating revenue from day one. Whether you need a new pizza oven, walk-in cooler, or a complete kitchen setup, the right financing helps you get cooking faster and more affordably.

I'm Sean Kearney, and I've spent years helping restaurant owners with restaurant equipment financing. My experience shows that the right financing strategy can transform how successfully restaurants launch and grow.

Understanding Your Restaurant Equipment Financing Options

Setting up your commercial kitchen doesn't have to drain your bank account. There are several smart restaurant equipment financing paths that can get you cooking without the financial stress.

Equipment loans are a straightforward option where you borrow money to purchase equipment outright, and the equipment itself acts as collateral. This makes approval easier since the lender has tangible security for the loan. With a loan, you own your gear from day one, building equity while making predictable monthly payments over 12 to 60 months.

Equipment leasing works like a long-term rental. You make regular payments to use the equipment, and at the end of the lease, you can buy it, return it, renew the lease, or upgrade. Leasing is ideal for equipment that updates frequently, like POS systems, as it keeps cash available and offers potentially tax-deductible payments.

Vendor financing is a time-saver where the company selling you equipment offers financing directly or through partners. The application is usually streamlined with fast approvals and terms designed for what you're buying.

Working capital loans offer flexibility for smaller equipment purchases or related costs like installation and training. These shorter-term loans boost operational cash flow.

Lines of credit work like a business credit card. You only pay interest on what you use, making them useful for unexpected small equipment needs. However, they aren't ideal for large purchases due to shorter repayment periods.

For more detailed guidance on these options, check out our comprehensive guide on navigating financing options.

How Equipment Financing Differs from Other Business Loans

Restaurant equipment financing is asset-based: the equipment you're buying becomes the collateral. This makes lenders more comfortable and offers several benefits.

Easier qualification is a major advantage. Since the lender can recover the equipment if needed, they're more willing to work with newer businesses or those with less-than-perfect credit.

Faster funding times are crucial for restaurants. Many alternative lenders understand this urgency and can approve applications within 24-48 hours, with some funding the same day.

The specific purpose of the loan streamlines the process. Unlike general business loans, equipment financing has a clear focus, making the application smoother.

According to financial experts, equipment financing can be essential for businesses needing tools quickly. You can explore the best restaurant equipment financing options of 2025 to compare different approaches and find a program that fits your needs.

Key Benefits of Financing Your Equipment

Financing your restaurant equipment is a smart business strategy with multiple advantages.

Improved cash flow is the biggest win. Instead of a large upfront payment, you make manageable monthly payments, keeping working capital available for payroll, inventory, and unexpected expenses.

Tax advantages can save you money. Lease payments are often tax-deductible, while equipment purchases may qualify for the Section 179 deduction, allowing you to deduct the full purchase price (up to $1,000,000 in 2024) in the year of use. Learn more about the Section 179 tax deduction to see how it could benefit your business.

Scalability becomes easier. Need to add a specialty pizza oven? Financing makes growth possible without waiting to save up the full amount.

100% financing options may not require a down payment. Many lenders cover the entire equipment cost plus shipping, installation, and training.

Predictable payments simplify financial planning. Fixed monthly amounts let you forecast expenses accurately.

Leasing vs. Buying: Making the Right Choice for Your Kitchen

Choosing between leasing and buying restaurant equipment is like deciding between renting an apartment or buying a house – both have their place, and the right choice depends on your situation. As someone who's helped countless restaurant owners make this decision, I can tell you there's no universal "best" option. It all comes down to your cash flow, long-term plans, and the specific equipment you need.

Let me break down the key differences so you can make the smartest choice for your kitchen:

| Feature | Leasing | Buying (with a loan) |

|---|---|---|

| Upfront Cost | Typically low or no down payment | Often requires a down payment |

| Ownership | No ownership during lease term | Own the equipment from day one |

| Flexibility | Easy to upgrade or return at term end | Equipment is ours; can sell or trade when we want |

| Maintenance | Often covered by lessor or service contract | Our responsibility |

| Tax Implications | Payments may be deductible | Section 179 deduction, depreciation |

| Long-term Cost | Can be higher than buying outright | Generally lower total cost if kept long-term |

| Balance Sheet | Off-balance sheet (operating lease) | On-balance sheet (asset & liability) |

| Obsolescence Risk | Low, easy to upgrade | Higher, stuck with outdated tech |

| Collateral | Equipment is collateral for lessor | Equipment is collateral for the loan |

For more detailed information on leasing, check out our guide on commercial kitchen equipment leasing.

Advantages and Disadvantages of Leasing

Leasing can be a game-changer for restaurants that need to preserve cash flow or want the latest technology. Think of it as the "try before you buy" approach to restaurant equipment financing.

The biggest advantage of leasing is the lower upfront cost. You can get that new pizza prep table or commercial oven without draining your bank account. This keeps your working capital free for daily operations, inventory, and those unexpected expenses that always seem to pop up in the restaurant business.

Flexibility is another huge win. When your lease ends, you're not stuck with outdated equipment. This is especially valuable for items like POS systems, ice machines, and coffee machines that evolve quickly. You can simply upgrade to the newest model and stay competitive.

Tax benefits make leasing even sweeter. Those monthly lease payments are often fully tax-deductible as business expenses, which can significantly reduce your tax burden. Plus, leasing keeps equipment off your balance sheet, which can improve your financial ratios when applying for other financing.

But leasing isn't perfect. You won't build any equity in the equipment – it's like paying rent instead of a mortgage. If you plan to use equipment for many years, the total cost of leasing can exceed the purchase price. And once you sign that lease agreement, you're typically committed to the full term, even if your business needs change.

Advantages and Disadvantages of Buying

Buying equipment outright (or with a loan) makes sense when you're investing in the backbone of your kitchen. Full ownership means you're building equity in your business with every payment. Once that loan is paid off, you own a valuable asset that can even be sold or used as collateral for future financing.

There are no usage restrictions when you own your equipment. You can run that commercial oven 24/7 if needed, modify it to fit your space perfectly, or maintain it exactly how you want. You're the boss.

The tax benefits can be substantial too. The Section 179 deduction lets you write off the full purchase price of qualifying equipment (up to $1,000,000) in the year you buy it. For a $20,000 pizza prep table, that's a serious tax break that puts money back in your pocket.

Long-term, buying is usually cheaper. If you plan to use equipment for its full lifespan, the total cost of ownership beats leasing every time.

The downside? Higher upfront costs can strain your cash flow, especially for new restaurants. You're also responsible for all maintenance, repairs, and eventual replacement costs. And if technology advances rapidly, you might find yourself stuck with outdated equipment while competitors have newer, more efficient models.

The best equipment for buying includes ovens, ranges, walk-in coolers, heavy-duty mixers, and quality pizza prep tables – basically, the workhorses of your kitchen that you'll use for years to come.

Understanding End-of-Lease Options

One of the smartest things about leasing is the flexibility it gives you when the term ends. You're not locked into just one path, which is perfect for the ever-changing restaurant industry.

You can purchase the equipment if it's still serving you well. Most leases include a predetermined buyout price or let you buy at fair market value. This works great when you've fallen in love with a piece of equipment and want to keep it long-term.

Returning the equipment is the hassle-free option. Just give it back to the lessor and walk away. No worries about selling it yourself or dealing with disposal costs.

Renewing the lease gives you more time to decide, often at a reduced monthly rate. This works well when you need the equipment but aren't ready to commit to ownership.

Upgrading to new equipment is my personal favorite option for technology-heavy items. You can return the old equipment and lease the latest model, keeping your kitchen modern and competitive without missing a beat.

The key is planning ahead. Know which option you're leaning toward before you sign that initial lease agreement, so you can negotiate terms that work best for your restaurant's future.

How to Qualify and Apply for Restaurant Equipment Financing

Getting approved for restaurant equipment financing doesn't have to feel like solving a complex recipe. With the right preparation and understanding of what lenders look for, you'll be well on your way to equipping your kitchen with the tools you need to succeed.

The application process is typically faster than traditional business loans, with many lenders specializing in quick approvals. Most alternative lenders can provide decisions within 24-48 hours, and some even offer same-day funding once approved. The key is choosing the right provider who understands the restaurant industry and your specific needs.

When selecting a financing provider, look for lenders who work specifically with restaurants and food service businesses. They'll understand seasonal fluctuations, the importance of getting equipment quickly, and the unique challenges our industry faces. Alternative lenders often offer more flexibility than traditional banks, especially for newer businesses or those with less-than-perfect credit.

For startup restaurants, don't overlook our guide on restaurant equipment financing for startups, which covers options specifically designed for new businesses.

Key Eligibility for Restaurant Equipment Financing

Every lender has their own recipe for approval, but most look at similar ingredients when evaluating your application. Understanding these requirements upfront helps you prepare and increases your chances of approval.

Time in business is often the first thing lenders consider. Traditional lenders typically want to see at least one to two years of operating history. However, many alternative lenders are much more flexible, with some approving businesses that have been operating for just a few months. They understand that great restaurants can succeed quickly with the right equipment and planning.

Your annual revenue tells lenders whether your business generates enough income to handle the financing payments comfortably. While some lenders like Balboa Capital look for $100,000 or more in annual revenue, others are willing to work with smaller operations, especially if you have a solid business plan and growth projections.

Both your personal and business credit scores play important roles in the approval process. A personal FICO score of 620 or higher is often preferred, but don't let a lower score discourage you. Many lenders specialize in working with various credit profiles, understanding that a strong business concept can sometimes outweigh past credit challenges.

Your business plan becomes especially crucial if you're a startup or seeking significant financing. This document should clearly outline your vision, target market, operational strategy, and financial projections. It shows lenders you've done your homework and have a clear path to success. If you're just getting started, our checklist for opening a restaurant can help you organize your thoughts and prepare for the application process.

Documentation You'll Need

Having your paperwork organized before you start the application process makes everything run smoother. Think of it like having all your ingredients prepped before you start cooking – it just makes the whole process more efficient.

The loan application itself is straightforward, asking for basic information about your business and personal background. Most lenders provide this online, making it easy to complete from your restaurant or home office.

Bank statements from the last three to six months give lenders a clear picture of your cash flow patterns. They want to see consistent deposits and understand how money flows through your business, including any seasonal variations that are common in our industry.

Your financial statements including profit and loss statements and balance sheets for the past two years help lenders understand your business's financial health. If you're a newer business, provide whatever statements you have available, along with interim reports showing your current performance.

The equipment quote or invoice is crucial – this shows exactly what you plan to purchase and how much financing you need. At Pizza Prep Table, we're happy to provide detailed quotes that work perfectly for financing applications.

You'll also need your business licenses and registrations to prove your operation is legally established. Sometimes lenders may request business tax returns for additional verification, especially for larger financing amounts.

Can Startups or Businesses with Bad Credit Qualify?

Absolutely! Every successful restaurant started somewhere, and lenders increasingly recognize that new businesses and those rebuilding their credit can be excellent partners.

Startup restaurants have more options than ever before. While traditional banks might hesitate to work with new businesses, alternative lenders actively seek out promising startups. They focus on the strength of your business plan, your industry experience, and your growth potential rather than just your operating history.

The equipment itself serves as collateral, which reduces the lender's risk and makes them more willing to work with newer businesses. If you have a solid concept, a good location, and realistic financial projections, many lenders will give you serious consideration.

Businesses with credit challenges shouldn't give up hope either. Alternative lenders often look at the bigger picture – your current cash flow, the value of the equipment you're financing, and your overall business health. While you might face slightly higher interest rates, these options keep financing accessible when traditional banks say no.

Companies like Amerifund specifically work with businesses that have low credit scores or even past bankruptcies. The key is demonstrating your ability to repay the financing through strong cash flow and a realistic business plan.

Restaurant equipment financing is asset-based, meaning the equipment itself provides security for the loan. This makes lenders more comfortable working with businesses they might not approve for unsecured financing. For more guidance on getting started in the restaurant business, check out our tips on starting a restaurant.

Frequently Asked Questions about Restaurant Equipment Financing

Running a restaurant means dealing with endless questions, and restaurant equipment financing certainly brings up its fair share. After years of helping pizzeria owners and restaurant managers get the equipment they need, I've heard just about every concern imaginable. Let me tackle the big ones that keep coming up.

What types of restaurant equipment can I finance?

Here's the beautiful thing about equipment financing: if it helps you run your restaurant, you can probably finance it. I've seen everything from massive pizza ovens to simple prep tables get approved for financing.

The cooking essentials are obvious candidates - commercial ovens, ranges, fryers, and griddles all qualify. If you're running a pizza shop, that wood-fired or deck oven you've been dreaming about is absolutely financeable. We've helped countless pizzeria owners secure financing for everything from compact countertop ovens to those impressive brick beauties that become the centerpiece of an open kitchen. Check out our guide on pizza oven financing for specific details.

Refrigeration equipment is another big category. Walk-in coolers, reach-in freezers, and those essential refrigerated prep tables (yes, including our pizza prep tables!) all qualify. Ice machines, beverage coolers, and even specialized wine storage can be financed too.

Don't forget about the behind-the-scenes heroes - commercial dishwashers, heavy-duty mixers, food processors, and slicers. Even your POS systems and dining room furniture can often be included in financing packages.

Here's a pro tip: many lenders will also finance soft costs like shipping, installation, and training. So when you're getting that new equipment quote, ask about rolling everything into one financing package.

How quickly can I get approved and receive funds?

Speed matters in the restaurant business. When your main cooler dies on a Friday night or you spot the perfect equipment deal that won't last, you need financing that moves fast.

Most alternative lenders can approve applications within 24 to 48 hours. I've seen some get approval decisions in just a few hours during business hours. The key is having your paperwork ready - complete applications with all supporting documents move through the system much faster.

Funding typically happens within 2 to 7 business days after approval, though some lenders can get funds to you same-day in urgent situations. The exact timing depends on the lender, the amount being financed, and how complex your situation is.

What affects approval speed? Complete applications move fastest. Missing bank statements or unclear equipment quotes slow things down. Also, if you're responsive when lenders have follow-up questions, you'll get approved faster than someone who takes days to return calls.

What are common mistakes to avoid when seeking financing?

After watching hundreds of restaurant owners steer financing, I've noticed some patterns in what trips people up. Let me save you from the most common headaches.

Don't just compare interest rates - compare APRs instead. The interest rate only tells part of the story. The Annual Percentage Rate includes all the fees and charges, giving you the real cost of financing. A 6% interest rate with high fees might actually cost more than an 8% rate with no fees.

Budget for more than just the equipment price. Shipping a commercial pizza oven across the country isn't cheap. Installation might require electrical or plumbing work. Your staff needs training on new equipment. A good rule of thumb is to add 25-30% to your equipment cost for these extras. The smart move? Find financing that covers these soft costs too.

Read every word of your financing agreement. I know, I know - nobody likes fine print. But prepayment penalties, late fees, and terms that can change without notice are all hiding in there. Take the time to understand what you're signing.

Match your financing type to your equipment needs. This is huge. Leasing works great for POS systems that need regular updates, but it doesn't make sense for a commercial oven you'll use for 15 years. Buy long-lasting core equipment like ovens and prep tables. Lease technology that becomes obsolete quickly.

Consider your seasonal cash flow. If your revenue fluctuates with tourist seasons or holiday rushes, look for lenders offering flexible payment schedules. Some allow seasonal payments that match your busy and slow periods, making it much easier to manage cash flow year-round.

The bottom line? Take your time, ask questions, and don't let anyone pressure you into signing before you're ready. Good lenders want you to succeed - they should be happy to explain everything clearly.

Conclusion: Equip Your Kitchen for Growth

The restaurant business moves fast, and having the right equipment can make or break your success. Whether you're flipping pizzas in a busy Houston shop or serving comfort food in Atlanta, your kitchen tools are the heart of everything you do. Restaurant equipment financing turns those scary big purchases into smart, manageable investments that help your business grow instead of draining your bank account.

We've covered a lot of ground together—from understanding the difference between equipment loans and leases to figuring out which option works best for your specific needs. The key takeaways? Preserve your cash flow for daily operations, take advantage of tax benefits like the Section 179 deduction, and choose financing that matches your equipment's lifespan and your business goals.

Don't let credit concerns hold you back. Even if you're just starting out or your credit isn't perfect, there are lenders who specialize in working with restaurant owners like you. They understand that a great business plan and industry knowledge often matter more than a credit score.

At Pizza Prep Table, we've seen how the right financing opens doors. We work with pizzeria owners from coast to coast—from the busy streets of New York City to the food scenes in Los Angeles, Chicago, and everywhere in between. We know that getting quality equipment shouldn't be the thing that stops you from following your culinary dreams.

Smart financing is your secret weapon. It keeps your kitchen running smoothly, your customers coming back, and your business ready to grow when opportunities come knocking. Whether you need your first pizza prep table, want to add a specialty oven, or plan to expand your entire operation, the right financing strategy makes it all possible.

Ready to turn your restaurant vision into reality? Explore our commercial kitchen equipment and financing solutions and let's get your kitchen equipped for success. Your customers are waiting, and we're here to help you serve them better.