Restaurant Equipment Financing for Pizza Startups | Get Funding Today

Share

Starting your dream pizzeria is an incredible journey, but it comes with a major hurdle right out of the gate: the staggering cost of essential gear. High-quality commercial pizza ovens and efficient pizza prep tables can easily stop you in your tracks, but they don't have to.

Think of restaurant equipment financing for startups as a strategic tool, not just a loan. It's a way to get the equipment you need to open your doors now without completely wiping out your cash reserves. This smart approach lets your equipment, from the deck oven to the pizza prep table, start generating revenue and essentially pay for itself over time.

Funding Your Pizzeria's Equipment The Smart Way

A great pizzeria is built on a foundation of fresh dough, bubbling cheese, and that perfect, crispy crust. But long before you serve your first slice, you're faced with the reality of outfitting your kitchen. The price tags on the must-have items, especially a workhorse pizza oven and a functional pizza prep table, can be a serious shock to a startup budget.

Many new pizzeria owners fall into the trap of thinking they need to pay for everything in cash upfront. This can be a critical mistake, dangerously depleting your capital and leaving you with little to no cushion for other crucial day-one expenses like rent, payroll, your initial ingredient order, and marketing. There's a much smarter way to play the game.

Preserve Capital and Get the Best Gear

Restaurant equipment financing isn't just about borrowing money; it's a strategic move to protect your cash flow. Instead of sinking tens of thousands of dollars into equipment before you've even made a single sale, financing lets you make smaller, predictable monthly payments. This keeps your bank account healthy for all the unpredictable costs that come with opening a new pizzeria.

The core idea is simple: let the equipment pay for itself. A top-tier pizza oven and an efficient pizza prep table are revenue-generating assets. Financing allows you to acquire them immediately, so they can start making you money from day one.

This isn't some niche strategy; it's how most pizzerias and restaurants operate. In fact, a staggering 82% of U.S. businesses that acquire equipment use some form of financing. It's all part of an equipment finance industry valued at over $1.3 trillion, which just goes to show how vital this approach is for getting businesses off the ground.

Smart financing gives you the breathing room to build a successful pizzeria without the stress of a massive upfront cash outlay. It’s about working smarter, not harder, with your startup capital.

Before you invest in your pizzeria's equipment, it's helpful to see a clear breakdown of why financing is often the smarter move compared to a large cash purchase.

Why Financing Your Pizza Equipment Makes Sense

| Benefit of Financing | Impact on Your Pizzeria Startup |

|---|---|

| Preserves Your Cash | Keeps your capital free for operating expenses like rent, pizza ingredients, and marketing. |

| Immediate Revenue Generation | Your new pizza oven and prep table start making you money right away, helping to cover their own cost. |

| Access to Better Equipment | You can afford the reliable, high-performance gear you need, not just what you can buy with cash. |

| Predictable Monthly Costs | Fixed payments make it easy to budget and manage your monthly expenses. |

| Builds Business Credit | Timely loan payments establish a positive credit history for your new pizzeria. |

| Tax Advantages | Lease payments can often be deducted as a business expense, reducing your overall tax burden. |

Ultimately, choosing to finance is a strategic decision that turns a potentially crippling upfront cost into a manageable operational expense, setting you up for long-term success.

From Ovens to Prep Tables

This kind of financing can cover nearly every piece of equipment your new pizzeria needs. While the oven is the heart of any pizza operation, your entire workflow hinges on the efficiency of your prep area. A well-designed pizza prep table is absolutely critical, and you can learn how to prep like a pizza pro with these topping stations to truly understand their importance.

By financing these key pieces, you can:

- Acquire Better Equipment: Get the reliable pizza oven and efficient pizza prep table you actually want without being forced to settle for cheaper, less effective alternatives that might fail during a dinner rush.

- Protect Your Cash Reserves: Keep your liquid capital ready for marketing pushes, hiring great staff, and covering any unexpected costs that pop up.

- Build Business Credit: Making your equipment loan payments on time is one of the best ways to establish a positive credit history for your new pizzeria, which will help you secure better terms on future financing.

At the end of the day, financing turns a huge capital expenditure into a predictable operating expense. It empowers you to bring your pizzeria vision to life without having to empty your pockets before you even open the doors.

Choosing Your Path: Loans Versus Leases

Alright, so you’ve decided to seek financing. Now you’ve hit your first big fork in the road: should you get an equipment loan or sign a lease? This isn't a small decision. The path you choose right now will have a real impact on your pizzeria's financial health, especially during those make-or-break early months. Getting a handle on the core difference between these two is the key to picking the right restaurant equipment financing for a startup like yours.

Here’s a simple way to think about it. Getting an equipment loan is a lot like buying a house. You make monthly payments, you build equity, and when it's all said and done, that valuable asset—like your shiny new pizza oven—is 100% yours. On the other hand, a lease works more like renting an apartment. You pay a monthly fee to use the equipment, like a state-of-the-art pizza prep table, for a set amount of time.

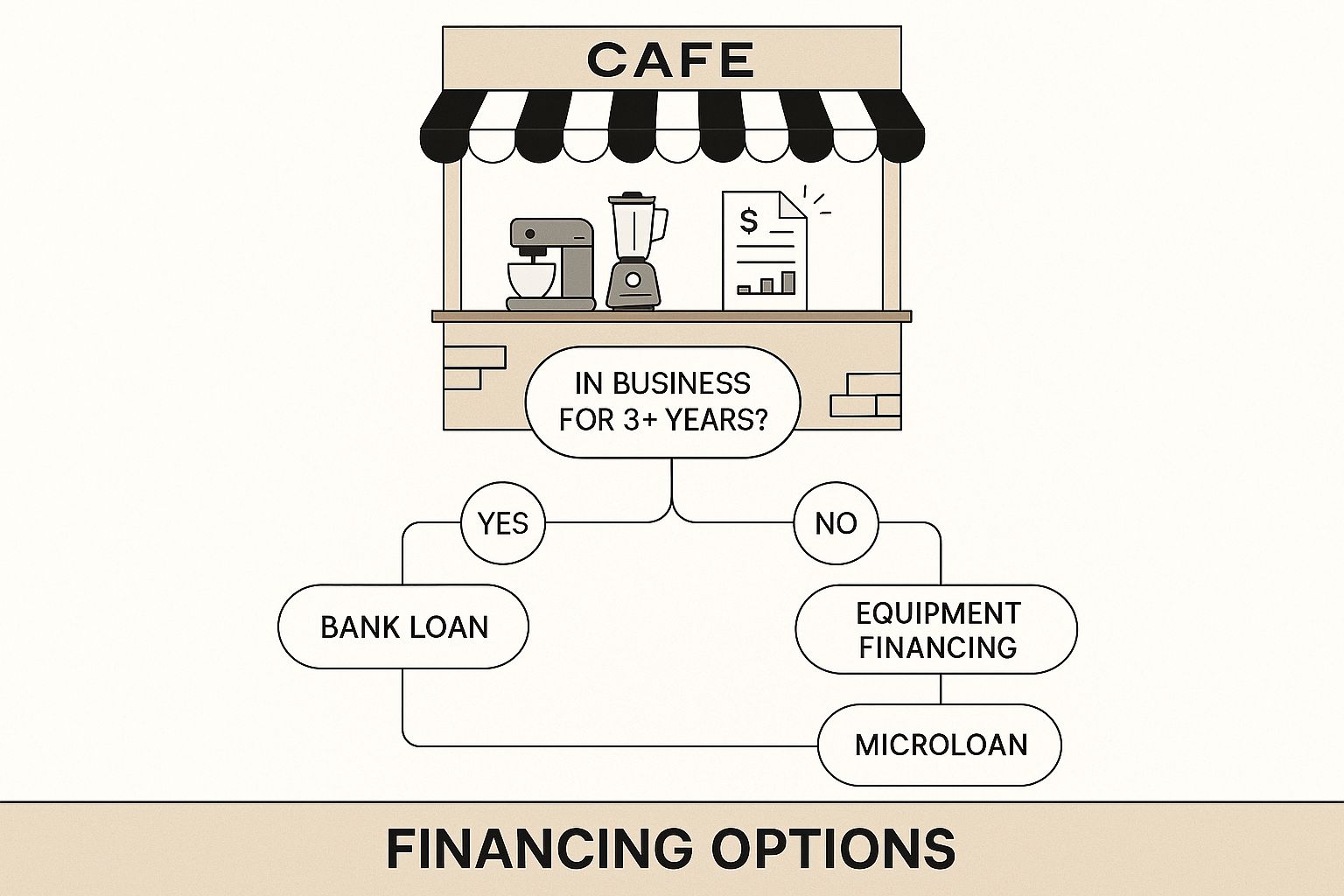

This visual breakdown really helps clarify the decision points you'll face.

As you can see, your end goal—whether it's long-term ownership or keeping things flexible for the short term—is what really guides you toward one path or the other.

The Loan Approach: Ownership and Equity

An equipment loan is about as straightforward as it gets. A lender gives you the cash you need to buy your pizzeria's equipment outright. That equipment, from your walk-in cooler to your pizza prep table, then acts as the collateral for the loan itself. This is the ideal route for entrepreneurs who see their gear as a long-term investment.

There are some major upsides to taking out a loan:

- Full Ownership: Once you make that final payment, the equipment is yours, free and clear. You can keep using it for years, sell it for a cash injection, or even use it as collateral for your next business venture.

- Building Business Assets: Every piece of equipment you own adds to your pizzeria's balance sheet. This increases its overall value and equity, which looks great to future investors or lenders.

- Potential Tax Benefits: You can often deduct the interest payments and the equipment's depreciation on your taxes. Talk to your accountant about this—it can lead to some serious savings.

The catch? Loans usually require a bigger down payment and a stronger credit history, which can be a tough hurdle for a brand-new pizzeria just getting off the ground.

The Leasing Strategy: Flexibility and Lower Upfront Costs

For startups where cash flow is king, leasing is often a perfect fit. Instead of buying, you're essentially renting the equipment for a specific term, which is usually somewhere between two and five years. This is especially smart for tech-heavy gear that can become outdated quickly, like certain POS systems or even specialized pizza prep tables with fancy new features.

A huge reason startups go the leasing route is to get around those intimidating upfront costs. When the average cost to open a restaurant can be anywhere from $275,000 to $750,000, leasing makes getting your hands on expensive gear much more manageable. You can get more insights on these startup costs over at 7shifts.com.

When your lease term is up, you typically have a few choices. You can return the equipment, renew the lease (often at a lower rate), or buy the item for its fair market value. For a new pizza shop, this flexibility is golden. It means you can get the best pizza prep tables and ovens working for you today without being locked into owning them forever.

Budgeting the Real Cost of Your Pizzeria Equipment

When you walk into a lender's office asking for restaurant equipment financing for startups, a solid, detailed budget is your best friend. They want to see more than just a single, big number. They need proof that you've thought through the real cost of getting a pizzeria up and running.

This means looking past the obvious stuff. Of course, everyone budgets for the pizza oven—it’s the heart and soul of your operation. But a truly convincing financial plan digs deeper, accounting for all the unsung heroes that keep a kitchen from grinding to a halt on a busy Friday night. Think dough sheeters, commercial mixers, and especially the high-quality pizza prep table that protects your investment in ingredients.

Beyond the Pizza Oven: A Complete Shopping List

A comprehensive equipment list does more than just add up costs; it tells a story. It shows a lender you're prepared and have mentally walked through every step of making a pizza, from mixing the dough to that final, glorious bake. A piece of that story that often gets overlooked is the pizza prep table.

This isn't just a slab of stainless steel. It’s the command center of your entire pizza assembly line. A top-notch refrigerated pizza prep table keeps your toppings perfectly chilled, your workflow smooth, and your pizzas consistent, even when the orders are flying in. If you want to go deeper, we've put together a guide on the essential commercial food prep equipment every pizzeria owner should consider.

Your budget needs to be specific. Break it down with line items for everything, including:

- Baking: Deck or conveyor pizza oven

- Dough Prep: Commercial mixer, dough sheeter, and dough boxes

- Refrigeration: Walk-in cooler, reach-in freezer, and that all-important pizza prep table

- Cooking Line: Fryers for sides like wings, griddles, or ranges

- Storage: Stainless steel shelving and ingredient bins

- Warewashing: A 3-compartment sink and a commercial dishwasher

New Versus Used Equipment: Cost Estimates

The decision between new and used gear will have a huge impact on your startup budget. New equipment gives you the peace of mind of a warranty and peak reliability. Used equipment, on the other hand, can slash your initial cash outlay significantly. Showing a lender you've priced out both options for your key items, like your pizza oven and pizza prep table, demonstrates that you’re thinking critically about managing costs.

Here’s a quick look at some typical cost ranges to help you start building out your budget:

| Equipment Category | New Cost Range | Used Cost Range |

|---|---|---|

| Pizza Deck Oven | $5,000 - $30,000 | $2,500 - $15,000 |

| Pizza Prep Table (72-inch) | $3,500 - $8,000 | $1,500 - $4,000 |

| 60-Quart Spiral Mixer | $8,000 - $20,000 | $4,000 - $10,000 |

| Walk-In Cooler | $6,000 - $15,000+ | $3,000 - $8,000 |

This kind of detailed budgeting does more than just get you ready for a loan application. It forces you to build a credible financial narrative, one that proves you have a firm grasp on the real investment required to not just launch, but truly succeed in the pizza business.

How to Qualify for Restaurant Equipment Financing

So, what do lenders really look for when they size up a new pizzeria? When you're asking for restaurant equipment financing for startups, it’s not just about the numbers you put on a form. It’s about telling a convincing story. Lenders need to see that you've graduated from being a pizza dreamer to a serious planner.

The good news is, the qualification process isn't some big secret. It all comes down to a few key areas that are completely within your control, even before you've sold a single slice.

The Three Pillars of Qualification

For any pizza startup, lenders are trying to gauge risk. To do that, they zero in on three main factors to see if you've built a solid foundation for your pizza-making dream.

- Your Personal Credit Score: Since your pizzeria doesn't have a business credit history yet, your personal score is front and center. A score of 650 or higher is a great starting point. That said, some specialized lenders are willing to work with scores in the lower 600s, especially if the rest of your application is rock-solid.

- Down Payment Capacity: While some programs offer 100% financing, coming to the table with cash for a down payment (10-20% is typical) speaks volumes. It shows the lender you have skin in the game and are personally invested in making your pizzeria a success.

- A Compelling Business Plan: This is your sales pitch, your playbook, and your proof of concept all rolled into one. A well-researched business plan that clearly lays out your unique pizza concept, your target customers, and realistic financial projections can absolutely make or break your application.

For a startup, the business plan is more important than almost any other document. It must prove that your pizzeria is a well-thought-out venture, not a speculative gamble on a new pizza oven.

Your Business Plan Is Your Story

Your business plan is where you prove you get the day-to-day reality of running a pizzeria. This is your chance to show lenders you’ve thought through every single detail, from your secret dough recipe to the exact pizza prep table you need to build an efficient kitchen workflow. For more in-depth guidance on securing funds, you can find a ton of great information on pizza restaurant financing options and what lenders need to see.

A powerful plan gets specific. It should include itemized quotes for the equipment you need. Think about it: when a lender sees a precise quote for a 72-inch refrigerated pizza prep table from a known supplier, it does something magical. It turns an abstract request for money into a tangible, logical investment in a specific, revenue-generating asset. Your plan needs to connect the dots, showing exactly how that prep table will help you serve more customers and drive profit. That's how you turn your application from a risk into a partnership.

Navigating the Application Process Step by Step

Applying for restaurant equipment financing for startups can feel like trying to follow a complex recipe for the first time. It seems intimidating, but just like perfecting a pizza, it gets a lot easier when you break it down into simple, manageable steps. Let’s walk through the entire journey, turning a potentially confusing process into a clear path toward outfitting your pizzeria.

The very first thing you need to do is get your house in order. Before you even think about talking to a lender, you have to gather your critical documents. For any startup, this means having your business plan polished, your personal financial statements ready, and detailed quotes for the exact equipment you need—like that essential 72-inch refrigerated pizza prep table. Showing up with this stuff ready tells lenders you’re serious, organized, and have a real vision for your pizzeria's success.

Finding the Right Financing Partner

Once your paperwork is lined up, it's time to find the right lender. Your local bank might seem like the obvious first stop, but they often have rigid requirements that are tough for new pizzerias to meet. Instead, your best bet is to focus on lenders who actually specialize in the restaurant industry.

These specialized financing companies get it. They understand the unique cash flow cycles of a pizzeria and know the difference between a deck oven and a conveyor oven. More importantly, they see a high-quality pizza prep table for what it is: a core, revenue-generating asset. Because they speak your language, they often offer more flexible terms and have a much higher approval rate for startups.

When you start seeing offers, it’s tempting to just look at the interest rate. Don't fall for that. A low rate can be a smokescreen for an agreement loaded with hidden fees, harsh prepayment penalties, or a nasty end-of-term buyout clause. Always, always ask for a full breakdown of the total cost of financing.

Comparing Offers and Asking the Right Questions

Getting multiple offers is a fantastic place to be, but it means you have some homework to do. I always recommend creating a simple comparison sheet to lay out the key terms from each lender side-by-side. It makes the differences pop.

Before you even think about signing, make sure you get crystal-clear answers to these critical questions:

- What is the total APR? This is the big one. It includes the interest rate plus all the fees, giving you the true cost of the loan.

- Are there any prepayment penalties? You want the freedom to pay off your loan early if your pizzeria becomes a runaway success. Don't get stuck in a loan you can't get out of.

- What are my options at the end of the term? This is crucial for leases. Can you purchase the pizza prep table? If so, for how much—a single dollar, or its fair market value? The difference can be thousands of dollars.

- How quickly can I get funded? In the startup world, time is money. Many equipment-focused lenders can approve applications and get you the funds in as little as 24-48 hours.

By following this process with a bit of diligence, you stop being just a hopeful applicant and become an empowered business owner. You’ll be able to confidently pick the best financing partner and lock in the terms that will help your new pizzeria crush it from day one.

Common Mistakes to Avoid When Financing Pizzeria Gear

Getting your restaurant equipment financing for startups approved feels like a massive victory. It is! But don't pop the champagne just yet. The journey isn't over, and a few common—and costly—mistakes can easily trip up new pizzeria owners right after they get the good news.

Honestly, sidestepping these pitfalls is just as critical as securing the funds in the first place.

One of the most frequent errors I see is underestimating the full scope of your equipment needs. So many entrepreneurs get tunnel vision, focusing all their financing power on that big, shiny pizza oven. They forget that an oven alone doesn't make a pizzeria. Suddenly, they're scrambling to pay cash for other essentials, like a high-quality pizza prep table, creating a brutal cash flow crunch when they can least afford it.

Overlooking the Fine Print

It’s completely understandable to get swept up in the excitement of an approval and just skim the contract. But this is a huge mistake. Remember, lenders aren't your business partners; they're service providers with their own bottom line. You have to understand every single line of that agreement before you put your name on it.

A deceptively low monthly payment might be hiding a massive balloon payment at the end of a lease. That attractive low interest rate could be padded with hefty administrative fees that sneak up on you. These "small details" can quietly add thousands of dollars to your total cost over the life of the agreement.

Always ask for a complete amortization schedule. This isn't an optional document. It breaks down every single payment, showing you exactly how much is hitting the principal versus interest. It’s the only way to see the true, all-in cost of the financing.

Choosing the Wrong Financing Structure

Another common trap is picking a financing type that just doesn't line up with your actual business goals. For example, taking out a five-year loan for a piece of tech you know you’ll want to upgrade in two years is just inefficient. You'll be stuck making payments on an asset you don't even use anymore.

On the flip side, leasing a core, long-lasting workhorse like your main pizza deck oven or pizza prep table might mean you never build any real equity in your business's assets. A truly strategic approach means matching the financing to the equipment's lifespan and its role in your pizzeria.

To steer clear of these problems, here’s what I recommend:

- Lease Technology: For items with a shorter shelf life that you'll want to upgrade—think POS systems or new ordering tablets—leasing is often the smartest move.

- Buy Core Assets: Use loans for the foundational gear that will be the heart of your kitchen for years, like your pizza oven or a durable pizza prep table.

- Get a Second Opinion: Before you sign anything, have an accountant or a trusted advisor look over the offer. Their objective, experienced eyes can spot red flags you might miss in the excitement of the moment.

Your Top Financing Questions, Answered

Jumping into the world of restaurant equipment financing for startups can feel like a maze, especially when your main goal is getting that new pizzeria off the ground. Let's clear up some of the most common questions I hear from new owners.

Can I Finance Used Pizza Equipment?

Yes, absolutely. In fact, it's one of the smartest moves you can make. Many lenders are more than happy to finance used pizza equipment, and it's a fantastic way to slash your startup costs. This strategy can get a high-quality, second-hand pizza oven or pizza prep table into your kitchen without you having to drain your cash reserves.

Just know that lenders will likely want to see a professional appraisal or inspection. They need to confirm the gear is in good shape and worth what you're paying. You might also see slightly shorter repayment terms compared to buying brand-new, but the upfront savings usually make it well worth it.

What Credit Score Do I Need for Equipment Financing?

While a personal credit score of 650 or higher is the sweet spot that unlocks the best rates and terms, don't panic if you're not there yet. I've worked with many alternative lenders who specialize in helping startups and are often willing to work with scores as low as 550.

For a new pizzeria without a business credit history, lenders often look beyond just the score. They'll pay close attention to the strength of your business plan and the value of the equipment itself—like a commercial pizza prep table—because that gear acts as the loan's collateral.

How Fast Is the Approval Process?

This is where equipment financing really shines. Unlike traditional bank loans that can feel like they're moving at a snail's pace for weeks or months, most equipment financing applications get approved in a flash—often within 24 to 48 hours.

That kind of speed is a total game-changer. If you have your paperwork ready to go, you can get funded, purchase your essential pizza prep tables and ovens, and get that much closer to your grand opening without missing a beat.

Ready to equip your pizzeria for success? Pizza Prep Table offers a wide selection of top-tier prep tables and kitchen gear, all backed by flexible financing options designed for startups like yours. Find the perfect equipment to bring your vision to life at https://pizzapreptable.com.