Restaurant Equipment Financing for Your Pizzeria

Share

That sticker shock you feel staring at an invoice for a new pizza prep table is real. But draining your bank account to pay for it isn't your only move. In fact, for smart pizzeria owners, restaurant equipment financing is a strategic financial tool, not a sign of desperation. It’s how you get the gear you need without hamstringing your cash flow.

Why Smart Pizzerias Finance Equipment

Think of your pizzeria's cash reserve like a fresh batch of pizza dough. If you use the entire batch to build the foundation for one giant pizza—that shiny new prep table—you've got nothing left for the sauce, the toppings, or even the fuel for the oven. You're stuck with a single, massive investment and zero flexibility to run your day-to-day business.

Financing completely changes the game.

By getting a loan or lease for a major purchase, you keep your cash—your dough—pliable and ready for anything. That working capital you just protected can now go toward all the things that actually keep the lights on and the pizzas coming out of the oven.

- Covering daily expenses: We're talking payroll, rent, and utility bills. These don't stop just because you bought a new pizza prep table.

- Managing inventory: You can order all the cheese, pepperoni, and flour you need without nervously checking your bank balance.

- Seizing opportunities: A sudden chance to buy amazing local produce at a discount? A last-minute marketing push for the big game? Now you can actually say yes.

Protecting Your Pizzeria's Lifeline

Cash flow is the lifeblood of any restaurant, but it's especially critical for an independent pizzeria. Sinking all your funds into one piece of equipment is a huge, unnecessary risk. One unexpected repair, a slow sales week, or a sudden spike in ingredient costs can quickly spiral into a crisis if all your money is tied up in a single asset. A quick look at a typical breakdown of restaurant startup costs shows just how many things are competing for every dollar you have.

Restaurant equipment financing turns a large, scary capital expense into a predictable, manageable monthly operating expense. It smooths out your budget and protects your single most important asset: your liquidity.

This isn't some niche strategy; it's how the industry works. A report from the Equipment Leasing & Finance Foundation found that 67% of restaurant operators planned to replace kitchen equipment, which is driving a huge demand for financing as pizzerias modernize.

On top of that, savvy owners can pair financing with tax strategies like understanding bonus depreciation to accelerate tax deductions on new gear, which makes the financial picture even more attractive.

At the end of the day, financing isn't just about being able to afford a new prep table. It's about building a financially resilient business that's ready to grow.

Navigating Your Pizzeria Financing Options

So, you've decided financing your new pizza prep table is the smart move. Great. Now you're staring at a menu of options that can feel as complicated as perfecting a new dough recipe. But don't worry, it really boils down to three core choices: a traditional bank loan, an equipment financing agreement (EFA), or a lease. Each one gets you the equipment you need, just in a slightly different way.

The big question you need to answer first is about ownership. Do you want to own that prep table from day one, building equity in an asset for your pizzeria? Or would you rather have lower monthly payments and the freedom to upgrade to a newer, shinier model in a few years? Your answer will pretty much point you down the right path.

The Three Main Financing Flavors

I like to think of these options like choosing a pizza crust. Each one provides a different foundation for your financial strategy.

A traditional loan is like a thick, sturdy crust—reliable and built for the long haul. A lease, on the other hand, is more like a thin crust—it's lighter, more flexible, and easier to handle in the short term. An EFA fits somewhere in between.

Let's break down the ingredients of each one:

- Traditional Bank Loan: This is the classic financing route we all know. You borrow a lump sum from a bank to buy the pizza prep table and pay it back, with interest, over a set term. The big win here? You own the equipment immediately, which is great for building your pizzeria's asset sheet.

- Equipment Financing Agreement (EFA): This is a specialized loan where the equipment itself—your pizza prep table—acts as the collateral. EFAs are often faster and easier to get than bank loans because the lender's risk is tied directly to the asset. You still get ownership, but the loan is specifically for that one piece of equipment.

- Equipment Lease: With a lease, you're essentially renting the equipment for a fixed period. Your monthly payments are typically lower than loan payments because you're not paying for the full value of the table. At the end of the term, you usually have the option to buy it, return it, or lease a new one. For a deeper look at this popular option, check out our complete guide on commercial kitchen equipment leasing.

To really get a handle on all your choices, a good guide to equipment financing loans can be a huge help.

And this isn't a small corner of the financial world. The global equipment finance industry is projected to grow from $1.30 trillion to $1.44 trillion—that’s a 10.4% jump in just one year. While that number covers all sorts of industries, restaurants are a huge part of it. Let's be honest, the high cost of kitchen gear is one of the biggest hurdles for any new pizzeria owner.

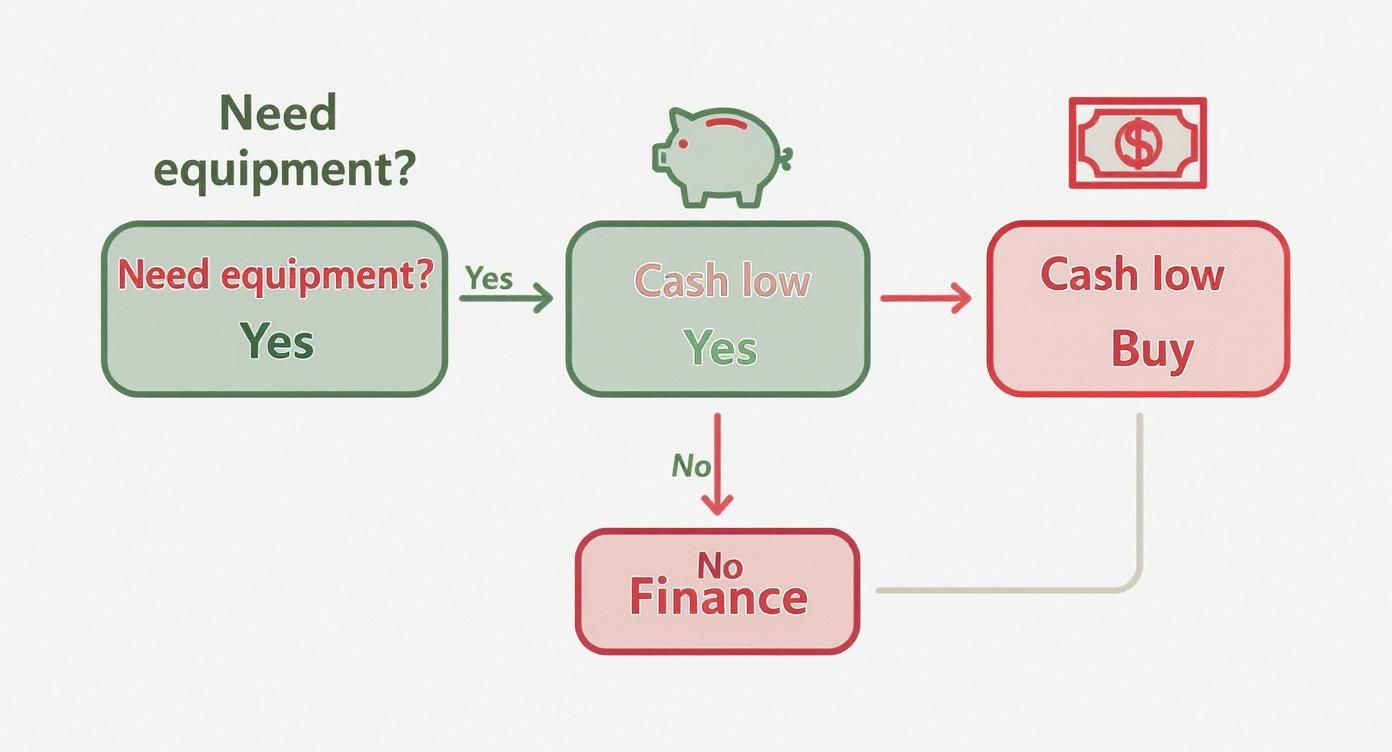

This simple infographic helps visualize the core choice between financing your pizza prep table or buying it outright with cash.

Comparing Financing Options for Your Pizza Prep Table

To make things even clearer, let's lay out the key differences side-by-side. Think of this as your cheat sheet for deciding which path is best for your pizzeria's financial health and future plans.

| Feature | Equipment Financing Agreement (EFA) | Equipment Lease | Traditional Bank Loan |

|---|---|---|---|

| Ownership | You own the equipment from the start. | The lender owns it; you have usage rights. | You own the equipment from the start. |

| Down Payment | Often 0% to 10%. | Typically first and last month's payment. | Usually requires 10% to 20% down. |

| Monthly Payment | Higher than a lease, as you're paying off the full value. | Lower, as you're only paying for depreciation. | Higher than a lease, paying off the full value. |

| End of Term | You own the equipment free and clear. | Options: buy, return, or upgrade. | You own the equipment free and clear. |

| Collateral | The equipment itself secures the loan. | Not applicable; it's a rental agreement. | May require additional business assets. |

| Best For | Pizzerias that want to build equity in long-lasting equipment. | Businesses wanting lower payments and frequent upgrades. | Established pizzerias with strong credit for general purchases. |

The key takeaway here is that there's no single "best" option—only the best option for you. Financing is almost always the most strategic move when you need to keep your working capital free for things like payroll, inventory, and marketing. Choosing the right financing flavor is all about aligning it with your pizzeria's goals for today and tomorrow.

Getting Approved for Equipment Financing

Trying to get financing for a new pizza prep table isn't as complicated as perfecting a secret sauce recipe. Lenders aren't trying to trip you up; they just need to understand the risk before they invest in your dream. Think of it like you're showing them the "ingredients" for your pizzeria's success—the better they look, the more confident they'll be.

You might hear lenders talk about the "Five Cs of Credit," which sounds a bit stuffy and intimidating. In reality, it’s just their checklist to see if you're a good bet for a loan. For a pizzeria owner like you, it boils down to some pretty straightforward questions about your business and your financial track record.

What Lenders Look For in Pizzeria Owners

When you apply for financing, a lender is basically becoming a short-term partner in your business. They want to see solid proof that your pizzeria is a safe bet, which means they’ll be looking at a mix of your personal financial health and your business’s stability.

Here are the key things they'll dig into:

- Personal Credit Score: This is usually the first stop. A strong personal credit score, typically 620 or higher, shows a history of managing debt well. It signals that you're reliable, which is a huge green light for any lender.

- Time in Business: Lenders love a proven track record. If your pizzeria has been open for at least one to two years and has steady revenue, you're already in a fantastic position. It proves your concept has legs and you know how to run the show.

- Business Revenue: Consistent cash flow is king. Lenders will ask to see your last three to six months of bank statements to make sure you have enough money coming in to comfortably handle a new monthly payment for that pizza prep table.

Having all your financial paperwork organized and ready to go is the single best thing you can do to speed up the approval process. Lenders really appreciate an applicant who comes prepared; it shows you're serious and professional.

Strengthening Your Application

So, what happens if you're a brand-new pizzeria without years of sales history? Don't sweat it—you still have great options. You just need to be a bit more strategic about how you make your case. It's all about proving your potential.

If you’re a startup or your credit history isn't perfect, focus on beefing up these areas:

- A Larger Down Payment: Putting down a good chunk of cash (say, 20-25%) dramatically lowers the lender's risk. It shows you have real skin in the game and you're committed to making this work.

- A Detailed Business Plan: A well-researched business plan is your absolute best friend here. It needs to include your projected revenue, a deep dive into your target market, and a clear plan for your operations. This tells lenders you’ve done the homework and you're not just winging it.

- Collateral: If you have other business assets you can use to secure the loan, it gives the lender an extra layer of security. This can seriously improve your chances of getting that "yes."

At the end of the day, getting approved is all about painting a clear picture of a viable, well-managed business. When you prepare your documents and play to your strengths, you make it easy for a lender to get excited about financing that brand-new pizza prep table.

Your Step-by-Step Financing Application Guide

The journey from spotting the perfect pizza prep table to finally hearing its quiet hum in your kitchen can feel like it’s paved with endless paperwork. But honestly, when you break it down, the restaurant equipment financing process is just a series of simple, logical steps.

Think of it like following a recipe. If you get all your ingredients measured and ready beforehand, the final dish comes out perfect. This guide will walk you through that process, turning a daunting task into a clear roadmap from quote to installation.

Step 1: Start with a Quote

Before you can ask for money, you need to know exactly how much you need. It all starts with finding the right pizza prep table for your pizzeria's workflow and getting an official quote from the supplier. This single document is the foundation of your entire application.

Make sure your quote clearly lists:

- The total cost of the pizza prep table itself.

- Any extra fees for shipping and installation.

- All applicable taxes.

This isn't just a casual price tag; it's the specific, final number you’ll be asking a lender to finance.

Step 2: Gather Your Financial Documents

Next up, it’s time to pull together what I call the "application packet." This is where you collect all the paperwork that gives lenders a clear picture of your pizzeria’s financial health. Being organized here is the secret to a fast, painless approval.

Generally, you'll need these items ready to go:

- Bank Statements: Most lenders want to see your last three to six months to get a feel for your revenue and cash flow.

- Business Identification: Have your business license and Employee Identification Number (EIN) handy.

- Equipment Quote: That all-important official document from your supplier is non-negotiable.

If your business is on the newer side, including a detailed business plan with financial projections can be a huge help. It shows lenders you’ve done your homework.

Step 3: Apply and Compare Offers

With your documents in hand, you can start reaching out to lenders. My advice? Don't just go with the first offer you get. It’s smart to get quotes from a few different sources—think traditional banks, online lenders, and specialists who only do equipment financing.

When you're looking at the offers, don't let a low monthly payment be the only thing you see.

Dig a little deeper. Pay close attention to the interest rate, the length of the term, and any hidden fees. A slightly lower monthly payment stretched over a longer term could end up costing you a lot more in total interest. It's a classic trap.

Once you’ve picked the best deal for your situation, you’ll formally submit the application. After you get the green light, the lender will usually pay the supplier directly. From there, all you have to do is coordinate the delivery of your new pizza prep table and get back to what you do best—making incredible pizza.

Choosing the Right Pizza Prep Table to Finance

Getting approved for restaurant equipment financing is a great feeling, but the real win is turning that money into a tool that actually makes you more profitable. A pizza prep table isn't just a hunk of steel; it's the command center for your entire pizza-making operation. Picking the right one is what makes your loan a smart investment instead of just another monthly payment.

You have to think beyond the price tag. How will this table hold up during the chaos of a Friday night rush? Will it make your workflow smoother, or will it create frustrating bottlenecks? This decision will echo through your kitchen's efficiency—and your profits—for years to come.

Key Factors for Your Pizzeria

Before you even think about signing a financing agreement, you need to get crystal clear on what your kitchen actually needs. The perfect table for a high-volume slice shop is a totally different beast from what a gourmet, sit-down pizzeria requires.

- Size and Layout: Get out the tape measure and be realistic about your space. A table that’s too big will disrupt the flow of your kitchen, while one that's too small will absolutely cripple your team's speed. A 67-inch model is a solid choice for many standard kitchens, but if you have the room and the order volume, a larger 93-inch workstation might be the right call.

- Refrigeration Capacity: Take a hard look at your menu. How many ingredient pans do you really need? The more complex your pizza offerings, the more refrigerated wells you'll need to keep every topping fresh and within arm's reach.

- Material and Durability: Don't settle for anything less than high-grade stainless steel. A pizzeria is a tough environment—you need a work surface that can stand up to constant use, acidic tomato sauce, and heavy-duty cleaning without breaking down.

This kind of careful planning is becoming the norm as operators get smarter about their equipment. Projections show the global market for these tools is set to explode, growing from USD 4.8 billion to USD 10.2 billion by 2035. Why? Because savvy owners are investing in kitchen gear that boosts efficiency. To see what's out there, you can explore a huge variety of models in our guide to the commercial pizza prep table.

New Versus Used Equipment

Another big fork in the road is whether to finance a brand-new table or go with a used one. Each option has its own set of trade-offs that will directly impact your financing deal.

A brand-new pizza prep table gives you the latest tech, a full manufacturer's warranty, and peak energy efficiency. That often translates to lower utility bills and fewer middle-of-the-rush repair calls, making it a super reliable long-term partner.

On the flip side, financing a used table can slash your upfront costs and lower your monthly payments, which can be a lifesaver for a new pizzeria. Just be aware that lenders might offer shorter financing terms or slightly higher interest rates for used gear because it has a lower collateral value. The real trick is to weigh the immediate savings against the risk of future maintenance bills and a shorter lifespan.

Your Top Pizza Equipment Financing Questions, Answered

When you're looking to finance new equipment, you've got questions. Getting clear, straightforward answers is the key to making a smart decision for your pizzeria. Let's cut through the jargon and tackle the most common questions we hear from operators just like you.

Can I Finance a Used Pizza Prep Table?

You absolutely can. Financing used equipment is a popular—and smart—move, especially if you're just starting out or watching your budget closely. Plenty of lenders are more than happy to finance pre-owned pizza prep tables.

Just know that the terms might look a little different than for a brand-new unit. Lenders typically offer shorter repayment windows, and the interest rate could be a bit higher. It’s nothing personal; it’s just that used equipment has less collateral value than something fresh off the factory floor.

To make the process go smoothly, have all the details ready: the table's age, its condition, and who you're buying it from.

What Credit Score Do I Need?

There isn't a single magic number, but most lenders feel comfortable seeing a personal credit score of 620 or higher. A score in that range shows a history of handling debt responsibly, which makes you a lower-risk applicant and often unlocks better interest rates.

Don't sweat it if your score is a little south of that. Some online lenders specialize in working with business owners in the high 500s. In that case, they’ll dig deeper into your pizzeria’s recent revenue and cash flow. A solid track record of sales can often make up for a less-than-perfect credit score, though you should probably brace for a higher interest rate.

The better your credit, the more doors open up. Taking some time to improve your score before you apply is one of the best things you can do to land lower rates and better terms. It can save you a serious amount of money over the life of the loan.

At the end of the day, lenders want the full financial picture. Your credit score is just one piece of that puzzle.

How Fast Can I Get the Money for My Equipment?

This is the big one, especially if your old prep table just died and you need a replacement, like, yesterday. The timeline for getting funded can vary quite a bit depending on who you work with.

Here’s a rough idea of what to expect:

- Online Lenders: These guys are built for speed. Many can get you an approval and have the funds sent to your equipment supplier in as little as 24 to 48 hours.

- Traditional Banks: Banks are thorough, which means they're slower. Their process is more detailed, so you could be looking at anywhere from a few days to a couple of weeks.

The biggest factor you can control is your own preparation. Have your official equipment quote, recent bank statements, and business documents organized and ready to go. Being prepared will speed things up, no matter which lender you choose.

Are There Tax Benefits to Financing a Prep Table?

Yes, and they can be a real boost to your pizzeria's bottom line. The exact tax perks you get depend on the type of financing you use.

For instance, if you use an equipment loan or an equipment financing agreement (EFA) to buy the prep table, you might be able to deduct the entire purchase price from your taxes in the first year. This is thanks to Section 179 of the U.S. tax code, which is designed to help small businesses invest in themselves.

On the other hand, if you decide to lease the equipment, your monthly lease payments are usually considered a deductible operating expense. This can lower your taxable income every single month.

Every pizzeria’s financial situation is different, so it's always smart to have a quick chat with your accountant. They can help you figure out which tax strategy will save you the most money.

Ready to find the perfect pizza prep table for your kitchen? At Pizza Prep Table, we offer a wide range of models from top brands, all backed by flexible financing options to help you grow your business. Explore our collection and get a free quote today!