Your Recipe for Success: Finding the Best Restaurant Equipment Leasing Company

Share

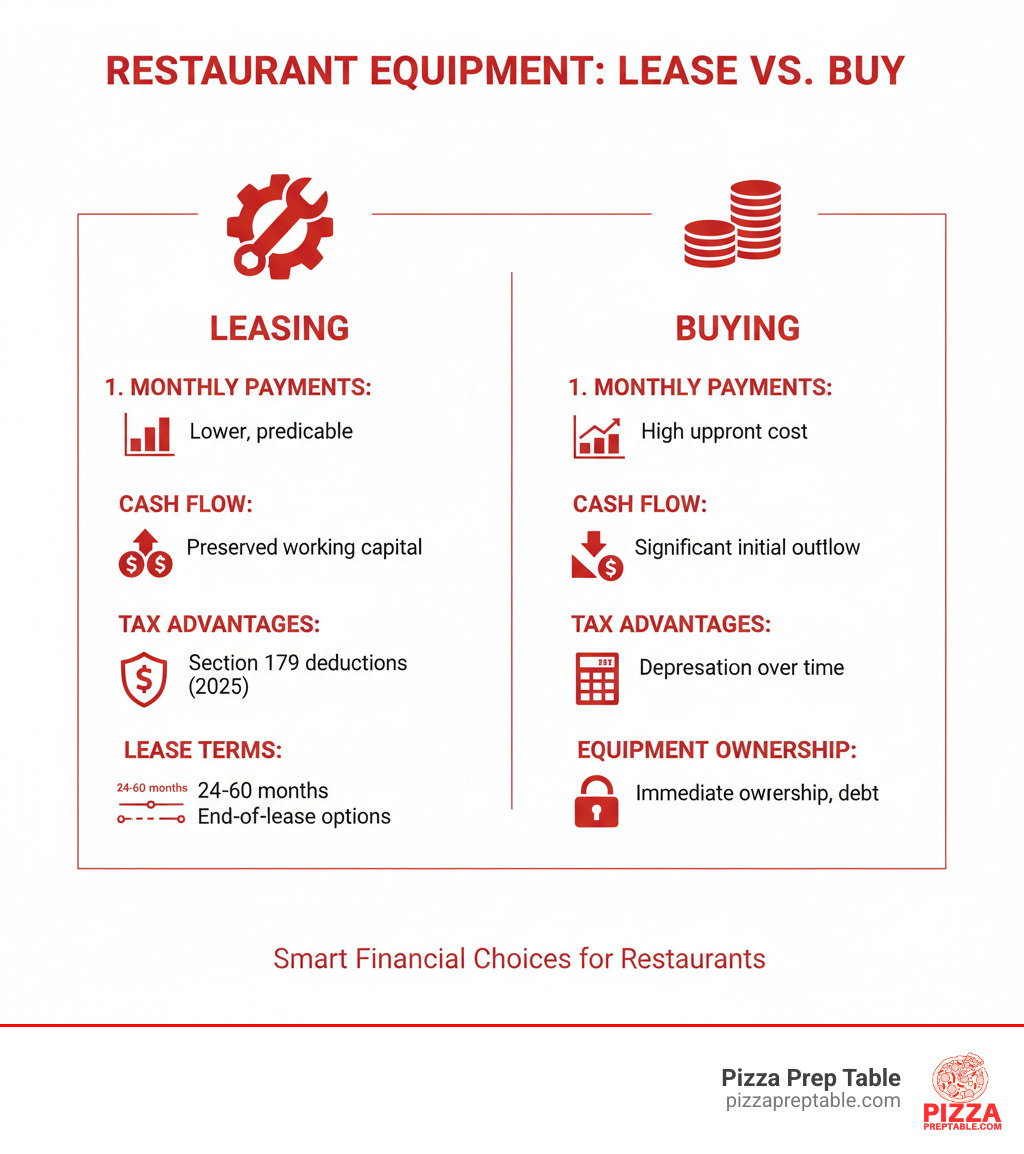

Why Smart Restaurant Owners Choose Equipment Leasing Over Buying

Restaurant equipment leasing companies offer a financial lifeline for pizzeria owners and restaurant managers facing the challenge of high upfront equipment costs. Instead of paying $50,000+ for a complete kitchen setup, you can spread those costs over 24-60 months while preserving your working capital for daily operations, inventory, and marketing.

Top Restaurant Equipment Leasing Companies:

- EconoLease - 35+ years experience, serves 85,000+ customers globally

- North Star Leasing - 45+ years in business, personalized service approach

- SPAR Leasing - Funding from $2,000 to $5,000,000+

- Titan Capital Funding - 24-hour turnaround, nationwide service

- Lease Genie - 100% financing with no down payments

The numbers tell the story: leasing frees up cash flow for payroll, marketing, and inventory while offering predictable monthly payments that match your restaurant's revenue cycle. Most applications get approved within 24-48 hours, and you can often finance 100% of equipment costs including shipping and installation.

As Pascal Lévesque from Résidence La Voisinière puts it: "There are many reasons I enjoy working with SPAR for my equipment purchase, one of them is the fact that I can consolidate my payments with several suppliers through one institution and know that I always have a great rate."

I'm Sean Kearney, and my background in sales - from baseball cards to Amazon.com - has taught me how to understand customer needs and find the right financial solutions. Having worked extensively with restaurant equipment leasing companies, I've seen how the right leasing partner can transform a struggling startup into a thriving business.

Restaurant equipment leasing companies vocab to learn:

- financing restaurant equipments

- lease restaurant equipment no credit check

Understanding Restaurant Equipment Leasing

Think of restaurant equipment leasing companies as your kitchen's fairy godmother - they help you get the equipment you need without the massive upfront costs that could drain your bank account. At its core, leasing is simply a partnership where you pay monthly to use professional equipment while the leasing company retains ownership.

Here's how it works in practice: Instead of dropping $15,000 on that dream pizza oven, you might pay $400 monthly for three years. This frees up your cash for ingredients, staff wages, and those unexpected expenses that always seem to pop up in the restaurant business.

The beauty of leasing lies in equipment use versus ownership. You get all the benefits of having top-tier kitchen equipment without the headaches of depreciation, storage concerns when upgrading, or being stuck with outdated technology. It's like having your cake and eating it too - except in this case, it's having your commercial kitchen and keeping your cash flow healthy.

Most restaurant equipment leasing companies make the process surprisingly straightforward: pick your equipment, submit an application, get approved (usually within 24-48 hours), sign the agreement, and start cooking. For more detailed insights into how this process works for specific equipment, check out our guide on Commercial Kitchen Equipment Leasing.

Types of Leases and Equipment

When working with restaurant equipment leasing companies, you'll encounter two main lease structures, each designed for different business goals:

| Lease Type | Description | End-of-Lease Option |

|---|---|---|

| Operating Lease (FMV) | Lower monthly payments, treat as rental expense | Return equipment, renew lease, or buy at fair market value |

| Finance Lease ($1 Buyout) | Higher monthly payments, builds toward ownership | Own the equipment for $1 at lease end |

The Fair Market Value (FMV) lease works like a long-term rental with flexibility. Your monthly payments stay lower because you're not paying toward ownership. At the end, you can walk away, extend the lease, or purchase the equipment at whatever it's worth in the market.

The $1 Buyout lease functions more like a financing plan. You'll pay more monthly, but you're essentially buying the equipment over time. When the lease ends, you own it outright for just one dollar.

Now, what can you actually lease? Almost everything your kitchen needs! Ovens of all types - convection, deck, and specialty pizza ovens - are popular lease items. Refrigerators including walk-ins, reach-ins, and our specialty pizza prep tables are frequently leased. For businesses needing consistent ice supply, Ice Machine Leasing offers a smart solution without the maintenance headaches.

Fryers, prep tables, and dishwashers round out the most commonly leased equipment. Whether you need a single piece or an entire kitchen setup, leasing companies can accommodate your needs.

Typical Lease Terms and Conditions

Most restaurant equipment leasing companies offer lease durations between 24-60 months, giving you flexibility to match payments with your equipment's useful life. A pizza oven might warrant a 60-month lease, while smaller prep equipment might work better with 24-36 months.

Payment structures adapt to your business rhythm. While monthly payments are standard, some companies offer weekly payments for cash-flow sensitive businesses or seasonal payments for operations like ice cream shops or seasonal cafes.

The end-of-lease options give you control over your equipment's future. Equipment return works well if you're ready to upgrade or the technology has evolved. Lease renewal lets you continue using equipment that's still serving you well, often at reduced rates. The purchase option varies by lease type - you might pay fair market value, a predetermined percentage, or just $1 depending on your original agreement.

These flexible terms make leasing attractive for businesses ranging from startup pizzerias to established restaurant chains looking to expand without major capital outlays.

The Financial Recipe: Key Benefits and Potential Risks

Think of restaurant equipment leasing companies as your financial sous chef - they help you create the perfect recipe for business success without burning through your cash reserves. When you lease instead of buy, you're making a strategic move that can transform how your restaurant operates financially.

The magic happens in your cash flow. Instead of dropping $50,000 upfront for a complete kitchen setup, you spread those costs over manageable monthly payments. This keeps your working capital free for the daily essentials - paying your staff, stocking fresh ingredients, and running those social media ads that bring customers through your door.

Your monthly lease payments become as predictable as your rent, making budgeting a breeze. As we explore in our guide on From Fryers to Funds: Navigating Restaurant Equipment Financing Options, smart financing isn't just about getting equipment - it's about making your money work harder for your business.

Maximizing Benefits: Tax Advantages and Upgrades

Here's where leasing gets really exciting for your bottom line. Those monthly lease payments? They're often fully tax-deductible as operating expenses. It's like the IRS is helping you upgrade your kitchen.

But wait, there's more. Section 179 of the IRS tax code is a game-changer for small and medium-sized restaurants. If you're financing less than $1,000,000 in equipment annually, you can deduct the full purchase price of qualifying equipment in the same tax year. Picture this: you finance a $10,000 pizza oven, and with Section 179 plus a 35% tax bracket, you could see a $3,500 tax deduction. That makes your effective cost just $6,500!

Leasing also works as your hedge against inflation. When you lock in today's monthly payments, you're essentially paying with tomorrow's dollars - which might be worth less due to inflation. It's like getting a discount that grows over time.

The restaurant industry moves fast, and staying competitive means having the latest equipment. Leasing gives you access to cutting-edge technology without the commitment. When that new energy-efficient fryer hits the market, you can upgrade without the headache of selling your old equipment or emptying your bank account.

Understanding the Risks

Every recipe has its challenges, and leasing is no different. Let's be honest about what you're signing up for.

Higher total costs are the biggest trade-off. Over the full lease term, you'll likely pay more than if you'd bought the equipment outright. Think of it as paying a premium for flexibility and cash flow preservation - sometimes that premium is worth it, sometimes it's not.

With most leases, you're not building equity. That pizza oven won't appear as an asset on your balance sheet, which means no ownership value. For some businesses, this is actually a tax advantage, but it's something to consider for your long-term strategy.

Early termination penalties can sting if you need to end your lease before the term expires. Life happens - restaurants close, pivot, or get bought out - but breaking a lease early usually costs extra.

Maintenance responsibility typically falls on your shoulders. While manufacturer warranties (like our Atosa equipment's five-year compressor warranty) provide some protection, routine upkeep and repairs are usually your responsibility. Always read the fine print to understand what maintenance costs you'll face.

Finally, contract limitations might restrict how you use, modify, or move your equipment. Some leases are stricter than others, so make sure the terms align with how you actually run your restaurant.

The key is understanding these trade-offs upfront, so you can make the choice that's right for your business. Sometimes preserving cash flow is worth paying a bit more over time - especially when that cash helps you grow faster than you could otherwise.

How to Compare Restaurant Equipment Leasing Companies

Choosing the right leasing partner is like hiring a sous chef: you need someone who understands your business, supports your goals, and is reliable. When evaluating restaurant equipment leasing companies, you're not just comparing numbers; you're choosing a financial partner for your restaurant's growth.

The most important thing to look for is customer service and support. You want a company that treats you like a person, not just a credit score. North Star Leasing stands out here - they assign dedicated Equipment Financing Experts to each client instead of relying on impersonal automated systems. When you call, you get someone who knows your account and understands your specific needs.

Industry experience makes a huge difference too. Companies like SilverChef Group (which owns EconoLease) have spent 35 years working exclusively with hospitality businesses. They've financed equipment for over 85,000 restaurants, cafes, and bars worldwide. This kind of specialized experience means they understand seasonal cash flow challenges, equipment wear patterns, and the unique pressures of restaurant life.

Flexibility in terms and payments can make or break a deal. The best leasing companies offer monthly, weekly, or even seasonal payment options. Some restaurants need lighter payments during slow winter months and can handle higher payments during busy summer seasons. Look for companies that can adapt their programs to match your business rhythm.

Vendor choice is another crucial factor. You shouldn't be locked into buying from the leasing company's preferred suppliers. The best restaurant equipment leasing companies let you work with any equipment vendor, whether you're buying new, used, or even private-sale equipment.

Evaluating Key Offerings from Leasing Providers

When comparing proposals, focus on the details that impact your bottom line. Interest rates and fees are key, but look for the full picture. Some companies advertise low rates but add origination fees, documentation fees, or other hidden costs.

Approval speed can be critical when you need equipment fast. Econolease and Titan Capital Funding both promise approvals within 24 hours, while Lease Genie offers same-day funding for many approved applications. If your pizza oven dies during your busiest weekend, waiting weeks for financing approval isn't an option.

Modern digital application processes and online management tools make your life easier. Look for companies that let you apply online, upload documents digitally, and manage your account through a web portal. Commercial kitchen equipment finance companies that accept technology tend to be more efficient and responsive overall.

The best leasing partners offer support beyond just financing. Some companies provide business advice, connect you with equipment suppliers, or offer resources to help you grow. They act like true partners in your success, not just lenders collecting monthly payments.

What to Look for in the Best Restaurant Equipment Leasing Companies

Reputation and reviews reveal how a company treats its customers. Look for testimonials from other restaurant owners, especially those in similar situations. A company with 30+ years in business and thousands of satisfied customers has a proven track record.

Specialization in hospitality matters more than you might think. A company that primarily finances construction equipment won't understand why you need faster approval times or seasonal payment flexibility. Hospitality-focused lenders know that restaurant equipment works harder and needs replacement more often than office furniture.

Transparency in terms should be non-negotiable. Everything should be clearly explained in plain English - no hidden fees, no confusing jargon, no surprises. If a leasing company can't explain their terms simply, that's a red flag.

The best companies provide personalized service with dedicated experts who get to know your business. You want someone who remembers that you're planning to expand next year or that you prefer equipment deliveries on Tuesdays when you're closed.

Finding Reputable Restaurant Equipment Leasing Companies for Startups

Starting a new restaurant is exciting, but getting financing without a credit history can feel impossible. The good news is that many restaurant equipment leasing companies specialize in helping new businesses get started.

Leasing offers huge advantages for startups. Instead of spending your entire budget on equipment upfront, you can spread those costs over time and keep cash available for inventory, marketing, and those inevitable unexpected expenses that pop up in your first year.

Startup-friendly programs often have more flexible credit requirements than traditional bank loans. Companies like Econolease work with various credit profiles, while Lease Genie prides itself on approving applications that other lenders reject. They understand that every successful restaurant started somewhere.

Your business plan becomes crucial when you don't have years of financial history. A solid plan that shows you understand your market, have realistic projections, and know how to run a profitable restaurant can overcome limited credit history. Check out our guide on Restaurant Equipment Financing for Startups for detailed advice on preparing your application.

Companies with experience in new ventures know what to look for beyond just credit scores. They evaluate your industry experience, the strength of your business concept, and your commitment to success. North Star Leasing and Lease Genie both have programs designed specifically for entrepreneurs who are just starting their restaurant journey.

The Leasing Application and Approval Process

Ready to get your hands on that shiny new pizza oven or prep table? The good news is that working with restaurant equipment leasing companies has never been easier. Gone are the days of drowning in paperwork and waiting weeks for an answer. Today's process is designed with busy restaurant owners in mind.

Eligibility Requirements

Let's be honest - every leasing company wants to make sure you can make your payments. But don't worry if your credit isn't perfect. Many restaurant equipment leasing companies understand that great restaurant owners sometimes have less-than-perfect credit scores.

Here's what most companies will look at: Your credit score matters, both personal and business, but it's not everything. Companies like Econolease work with various credit profiles, and Lease Genie actually specializes in getting approvals when others say "NO." Think of it as finding a lender who believes in your pizza dreams, not just your credit number.

Time in business can help your case, but startups shouldn't despair. Many companies like North Star Leasing and Lease Genie explicitly welcome new ventures. They know every successful restaurant started somewhere, and that somewhere might be right now.

You'll need to provide financial statements - recent bank statements, tax returns, and possibly profit & loss statements. It's like showing your report card, but for your business finances.

For newer restaurants, a solid business plan is your secret weapon. It shows you've thought things through and aren't just winging it. Need help building yours? Our Restaurant Startup Costs Breakdown can help you create a financial foundation that impresses lenders.

Step-by-Step: From Application to Equipment Delivery

The modern leasing process moves fast - sometimes faster than your busiest dinner rush. Here's how it typically unfolds:

The online application is your starting point. Most companies offer simple digital forms you can complete in just minutes. You'll specify exactly what equipment you need, its cost, and your preferred lease terms. No need to dress up for a bank meeting - you can do this in your chef's coat during a quiet afternoon.

Document submission happens digitally too. Upload your financial documents and business plan right through their portal. It's like sending a text, but with tax returns attached.

The credit check happens behind the scenes while you get back to running your restaurant. The leasing company reviews your credit history and financial health to determine your approval.

Here's where things get exciting - approval notifications often come within 24 hours. Some companies like Lease Genie even offer same-day funding for approved applications. Imagine applying for financing on Monday and having your equipment ordered by Tuesday.

Signing lease documents is handled electronically. No need to find a notary or mail anything. Review the terms, sign digitally, and you're done.

Finally, equipment shipment and installation begins once your paperwork is complete. Many leases include 100% financing, covering not just the equipment but also shipping, installation, and even sales tax. It's like getting everything wrapped up in one neat package.

The whole process leverages modern technology to make your life easier. Digital applications, online management portals, and electronic signatures mean you can go from "I need a new prep table" to "It's being delivered next week" faster than ever before. Some companies even offer online calculators, like Econolease's TFI lease calculator, so you can estimate your payments before you even apply.

The best part? You can handle most of this process during your restaurant's slower hours, without disrupting your daily operations. It's financing that works around your schedule, not the other way around.

Frequently Asked Questions about Restaurant Equipment Leasing

Running a restaurant comes with enough surprises - your equipment financing shouldn't be one of them. That's why we love answering questions from fellow restaurant owners who are exploring their options with restaurant equipment leasing companies. Here are the questions that come up most often in our conversations.

Can I lease used restaurant equipment?

Absolutely! This is a smart question. Many restaurant equipment leasing companies understand that every dollar counts, especially for startups or those on a tight budget.

The great part is you can lease almost any type of equipment—new, used, or even items from an equipment auction. This includes everything from our specialty pizza prep tables to heavy-duty mixers.

Plus, the Section 179 tax deduction works for both new and used equipment. This means you save money upfront by choosing used gear and also get potential tax benefits—a double win.

Are shipping and installation costs covered in the lease?

This is where leasing really shines! Most restaurant equipment leasing companies offer what they call 100% financing, which is exactly as good as it sounds. Your monthly lease payments can cover everything - the equipment itself, sales tax, shipping costs, and even professional installation.

Think about it: you order a new pizza oven, and instead of getting hit with surprise delivery fees or installation charges, everything gets rolled into one predictable monthly payment. No scrambling for extra cash when the delivery truck shows up, no unexpected bills from the installation team.

This approach makes budgeting so much easier. You know exactly what you'll pay each month, with no financial surprises waiting around the corner.

What happens if the leased equipment breaks down?

Now this is the question that keeps restaurant owners up at night - and rightfully so! Here's the straight answer: you're typically responsible for maintenance and repairs as the lessee. But before you panic, there's more to the story.

Most new equipment comes with solid manufacturer warranties that have your back during those crucial early months (or even years). For instance, Atosa equipment includes a five-year compressor warranty, while True Refrigeration covers you with 3-year parts and labor plus a 5-year compressor warranty. That's some serious peace of mind.

Your game plan should include reading your lease agreement carefully to understand exactly what you're responsible for, checking the equipment's warranty coverage so you know what's protected, and considering extended warranties or service contracts for equipment that's absolutely critical to your daily operations.

A good relationship with your leasing company means they'll often help guide you through these situations. After all, they want your business to succeed just as much as you do.

Conclusion

Finding the right restaurant equipment leasing companies doesn't have to feel like searching for the perfect pizza dough recipe in a cookbook written in another language. It's actually one of the smartest financial moves you can make for your restaurant's future.

Think about it: leasing gives you the financial flexibility to keep your cash flowing where it matters most - into fresh ingredients, great staff, and the marketing that brings customers through your doors. Instead of dropping $50,000 upfront on equipment, you can spread those costs over manageable monthly payments while still getting the commercial-grade gear that makes your kitchen hum.

The tax advantages alone can save you thousands. With Section 179 deductions and fully deductible lease payments, you're essentially getting Uncle Sam to help fund your equipment upgrades. And when new technology hits the market? You're not stuck with that old fryer for the next decade - you can upgrade and stay competitive.

You might pay a bit more over the long haul compared to buying outright. But here's the thing: cash flow is king in the restaurant business. Having working capital available for unexpected opportunities (or challenges) is worth its weight in mozzarella.

At Pizza Prep Table, we've seen how the right financing can transform a struggling startup into a thriving business. We're not just about supplying commercial pizza prep tables and kitchen appliances - we're about empowering your success, whether you're slinging pies in Phoenix or serving up slices in Seattle.

Our customers across the country, from Los Angeles to Chicago, Philadelphia to Houston, Boston to San Diego, have finded that smart financing is the secret ingredient to sustainable growth. We understand the unique challenges of pizzerias and foodservice businesses, which is why we're committed to connecting you with financing solutions that actually work.

Ready to cook up success without the cash stress? Start with our comprehensive guide to Commercial Kitchen Equipment Leasing and find how the right equipment can transform your kitchen.

Looking for specific equipment to get started? We've got you covered with everything from compact 44-inch Pizza Prep Tables perfect for tight spaces to spacious 93-inch Pizza Prep Tables that can handle your busiest nights. Check out trusted brands like Atosa Pizza Prep Tables or browse our complete selection of Pizza Prep Tables to find exactly what your kitchen needs.

Your perfect pizza prep setup is just a lease away - and your cash flow will thank you for it.