Unlock Your Kitchen: Financing Restaurant Equipment, No Credit Check Required

Share

Why Cash Flow Challenges Make Equipment Financing Critical for Restaurant Success

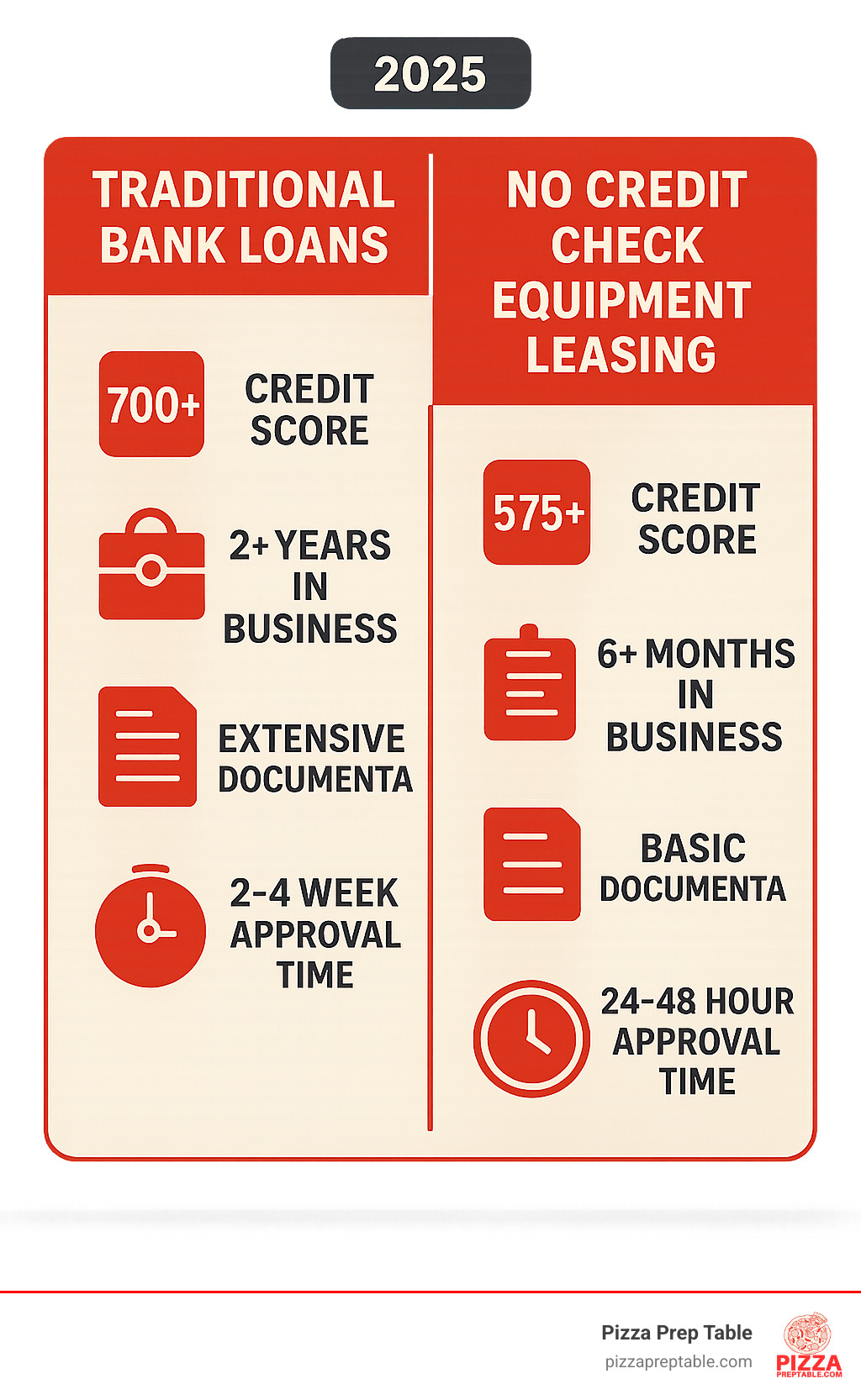

Lease restaurant equipment no credit check options are a game-changer for owners facing credit barriers. These solutions focus on business performance and cash flow, not credit scores, making equipment accessible to startups and established restaurants.

Quick Answer for Restaurant Equipment Leasing Without Credit Checks:

- Approval criteria: Based on business revenue, bank statements, and equipment value - not credit scores

- Typical requirements: 6+ months in business, $10,000+ monthly revenue, valid ID, and equipment quote

- Funding speed: 24-48 hours for approvals, 1-3 days for funding

- Payment terms: Usually 24-84 months with fixed monthly payments

- Equipment eligible: Pizza ovens, refrigerators, prep tables, dishwashers, mixers, and more

Cash flow challenges affect 82% of small businesses, making traditional bank loans difficult for many restaurant owners. As one industry expert noted: "No restaurant pays its staff in advance: they pay as they contribute. It is no different with restaurant equipment leasing."

A complete commercial kitchen can cost $100,000+, but most restaurants start with less than $20,000 in capital. Traditional loans take weeks and require perfect credit, leaving many dreams unfulfilled.

This is where no credit check equipment leasing steps in. Instead of focusing on credit history, these programs evaluate your business's ability to make payments. The equipment itself serves as collateral, making lenders more flexible.

I'm Sean Kearney, and my sales background has taught me how to find practical solutions for business owners who need to lease restaurant equipment no credit check. I've seen how the right financing transforms a struggling startup into a thriving pizzeria.

Decoding "No Credit Check" Equipment Financing

When you see "lease restaurant equipment no credit check," it doesn't mean lenders are flying blind. Instead of focusing only on your credit score, they use multiple factors to evaluate your business.

Most legitimate lenders still perform a soft credit pull. This doesn't impact your credit score but gives them a general financial overview.

These lenders use alternative approval criteria that make sense for your business. They focus on a simple question: Can your restaurant make money?

Revenue-based evaluation is key. If your pizzeria consistently brings in $15,000 a month, that tells them more about your ability to make payments than an old credit ding.

Bank statement analysis is crucial. Lenders analyze your deposits to see your daily sales and understand your cash flow cycles, proving you can run a profitable operation.

The real game-changer is asset-based lending. The equipment you're financing—whether it's a pizza oven or one of our pizza prep tables—serves as collateral. This significantly drops the lender's risk, making them more willing to work with owners who have less-than-perfect credit.

This focus on business health rather than credit history opens doors traditional banks keep locked. Your passion and smart business decisions matter more than a past financial hiccup. If you're wondering Is it Possible to Lease Restaurant Equipment with Bad Credit?, the answer is yes, thanks to these forward-thinking approaches.

The Upside: Key Benefits of This Approach

When you choose to lease restaurant equipment no credit check, you get a smart business strategy. We've watched countless pizzerias transform their operations with this approach.

Preserving your working capital is a huge win. Instead of spending $50,000 on a kitchen setup, you keep cash available for unexpected needs or opportunities.

The fast approval process is a major advantage over traditional bank loans. You could have new equipment generating revenue while competitors are still waiting on paperwork. Many programs approve within 24 hours and fund in 1-3 business days.

Accessibility for startups is a game-changer. Traditional banks often want two years of tax returns, but these programs may work with businesses as young as six months old. This lets you get professional equipment to compete from the start. Check out more info about startup financing to see how this works.

With fixed monthly payments, you can hedge against inflation. Locking in today's payment amount protects you if costs rise, keeping your budget predictable.

Most programs offer 100% financing, covering the equipment cost plus taxes, delivery, and installation, so there are no surprise expenses.

Those fixed monthly payments make budgeting simple. Unlike credit cards or revenue-based financing, you know exactly what you'll pay each month, helping you plan for growth with confidence.

Exploring Your Options: Types of No Credit Check Leases

Flexible restaurant equipment financing offers several paths, each designed for different business situations.

Lease-to-own programs are the most popular choice. You make monthly payments for 12 to 84 months and then own the equipment for a small final payment. This approach builds equity while keeping cash flow manageable.

Revenue-based financing ties payments to your daily sales. The lender takes a small percentage of your daily credit card sales. When business is slower, you pay less.

Merchant cash advances deserve caution. They are quick but often come with very high costs disguised as "factor rates." Always calculate the true annual cost before considering this option.

So what equipment qualifies? Pretty much everything your kitchen needs. These financing options typically cover commercial ovens, refrigerators and freezers, our specialty pizza prep tables from 44 to 93 inches, dishwashers, mixers, and ice machines. The list also includes work tables, prep stations, fryers, griddles, and POS systems. If it's essential for your restaurant, financing is likely available. You can learn about lease-to-own financing to understand these programs better.

How to Lease Restaurant Equipment No Credit Check: The Process Explained

Choosing to lease restaurant equipment no credit check is refreshingly simple. Modern online lenders have streamlined the process, helping owners get equipment quickly without weeks of paperwork.

Most providers offer simplified applications that you can complete online in minutes. You provide basic business information and details about the equipment you want to lease.

Instant decisions are a key feature. While rare for large amounts, many providers give a preliminary decision within 24 hours. Some programs offer same-day funding for purchases under $25,000.

Once approved, the funding speed is impressive. Expect funds within 24-48 hours for amounts between $25,000 and $100,000. Larger purchases might take 2-5 business days, which is still very fast. Some programs even issue digital debit cards for immediate use.

Typical Requirements to Lease Restaurant Equipment No Credit Check

While your FICO score isn't the deciding factor, lenders still need confidence in your ability to make payments. They want to understand your business's health without focusing on past mistakes.

Your bank statements are key. Lenders typically want to see your last 3-6 months of statements to review your cash flow, looking for consistent deposits and positive balances.

You'll also need an equipment quote or invoice for what you plan to lease. This helps the lender understand the asset's value. Having a clear quote for one of our pizza prep tables or a full kitchen setup makes the process smoother.

Valid ID is a standard requirement for the business owner.

The time in business requirement is often at least 6-12 months. Some providers work with businesses as young as 6 months old.

Monthly revenue is crucial. Most programs look for $10,000 or more in monthly revenue. Lenders might waive credit score requirements for businesses with substantial revenue (e.g., $500,000 annually) and at least 6 months of operation. For help planning, see A guide to restaurant startup costs.

Often, there's no minimum credit score required. While some lenders have a soft floor (like 575), the focus remains on your business's financial health.

Evaluating Terms, Rates, and Fees

While quick approvals are exciting, it's crucial to dig into the financial details before signing anything.

Understanding factor rates versus APR is critical. Many providers use factor rates, which are multipliers (e.g., a 1.15 factor rate means you repay $1.15 for every $1.00 borrowed). Always ask for the APR equivalent to compare options. Rates can range from 3.25% for qualified businesses to 18% or higher for newer operations.

Payment terms typically range from 24 to 84 months. These fixed payment periods align well with equipment lifespans.

Always ask about early payoff options. Many programs let you pay off your lease early, sometimes with discounts. Getting these details in writing can save you money. Some programs also offer deferred payments.

Watch out for hidden fees. Legitimate lenders are upfront about costs like application or administrative fees.

Here's a real-world comparison for a $10,000 pizza oven:

| Feature | Sample Lease-to-Own Plan | Sample Merchant Cash Advance |

|---|---|---|

| Equipment Cost | $10,000 | $10,000 |

| Factor Rate / Implied APR | 1.15 (approx. 15% APR) | 1.35 (approx. 40-60% APR) |

| Total Repayment | $11,500 | $13,500 |

| Payment Term | 36 months | 6-12 months (daily/weekly) |

| Monthly Payment (approx.) | $319.44 | $1,125 - $2,250 |

| End-of-Term Option | Own equipment for $1 or 10% | No ownership |

The lease-to-own option offers more manageable payments and ownership at the end, helping build your business rather than drain it.

Navigating the Risks and Building for the Future

While lease restaurant equipment no credit check options can be a lifesaver, not every lender has your best interests at heart. It's important to distinguish helpful partners from those focused only on their own profits.

The biggest red flag is a promise of "guaranteed approval" with no questions asked. Legitimate lenders need to understand your business, even if they're flexible on credit scores. An offer with zero review often signals predatory terms.

High interest rates are another warning sign. These programs cost more than bank loans, but be wary of excessively high rates. Always convert factor rates to APR to see the real cost.

Watch out for hidden fees. Trustworthy lenders are upfront about all costs, such as application or processing fees.

When you find the right lender and make payments consistently, you're not just getting equipment; you're building business credit. Many equipment financing companies report your payment history to major business credit bureaus like Dun & Bradstreet and Experian Business.

Every on-time payment strengthens your business credit foundation, while missed payments can damage it. Staying consistent will help your business credit score climb, opening doors to better financing terms.

Ask potential lenders: "Do you report payments to business credit bureaus?" If they don't, you're missing a key opportunity to strengthen your financial future.

Whether you're upgrading or starting from scratch, reliable equipment is crucial. Check out our guide on More on commercial kitchen equipment to see what might work for your operation.

How to Improve Your Credit for Better Terms

Using no credit check financing today doesn't mean you're stuck with higher rates forever. Think of your current lease as a stepping stone to building a stronger credit foundation.

Check your credit reports regularly, both personal and business. Errors are common and can drag down your score. Review them annually and dispute any inaccuracies immediately.

The golden rule of credit improvement is simple: pay every bill on time, every time. Late payments are very damaging. Set up automatic payments or reminders to ensure you qualify for better rates in the future.

If you haven't already, separate your business and personal finances completely with separate accounts and credit cards. Lenders prefer this organization, and it helps build a distinct business credit profile.

Dispute errors aggressively. Credit bureaus must investigate disputes, and removing incorrect negative items can provide an immediate boost to your score.

As your credit improves, you'll gain access to programs like SBA 7(a) loans, which offer up to $5 million with competitive rates and longer terms. Credit building is a marathon, not a sprint. Every payment you make today is an investment in better financing options tomorrow.

Frequently Asked Questions about No Credit Check Leasing

Here are answers to common questions from restaurant owners about no credit check leasing.

Can I really lease restaurant equipment no credit check?

Yes, but it's important to understand what "no credit check" means. It doesn't mean lenders ignore your financial background, which would be reckless. Instead, they focus on your business's current health, like cash flow and bank statements.

Many will do a "soft credit pull," which doesn't hurt your score. The key is that the equipment acts as collateral, reducing the lender's risk and making them more flexible on credit requirements.

Even with a credit score as low as 575, you can often qualify. The focus shifts from past mistakes to your business's future success. You can Get financing with bad credit when traditional banks say no.

Can this type of lease help build my business credit?

Yes, many of these leases can help build your business credit, but you must confirm this with the lender upfront.

Ask if they report your payment history to business credit bureaus like Dun & Bradstreet, Experian Business, and Equifax Business. If they do, your equipment lease becomes a credit-building tool.

Every on-time payment for your pizza prep table strengthens your financial foundation. Over time, this positive history opens doors to better financing. However, missed payments get reported too, so consistency is crucial.

What are the tax benefits of leasing equipment?

Equipment leasing offers substantial tax advantages, most notably the Section 179 deduction.

This deduction may allow you to write off the full purchase price of qualifying equipment in the first year instead of depreciating it over time. For most restaurant equipment under $1,000,000, you may be able to deduct the entire amount, potentially saving thousands in taxes.

Additionally, your monthly lease payments are typically considered tax-deductible operating expenses, reducing your taxable income.

Tax laws are complex, so I always recommend consulting a qualified tax professional. They can help you understand how these benefits apply to your pizzeria and maximize your savings. For more details, check out More on the Section 179 deduction.

The bottom line is that leasing can be a smart financial strategy that also saves you money at tax time.

Get the Equipment You Need to Grow Your Business

The conclusion is simple: when it comes to lease restaurant equipment no credit check financing, you have options. Your credit score no longer has to dictate your restaurant's future.

These flexible solutions focus on what matters: your business's cash flow and potential. Lenders evaluate your revenue, and the equipment itself serves as collateral, reducing risk and opening doors.

For new restaurant owners, this approach is empowering. You can equip your kitchen with essential tools like commercial ovens, refrigerators, and pizza prep tables without depleting your startup capital.

Established businesses with imperfect credit can also find new opportunities here to upgrade aging equipment or expand their operations when traditional banks might say no.

The benefits lie in the simplicity: fast approvals, predictable monthly payments, and the chance to build business credit as you grow. It's financing that works with your business.

At Pizza Prep Table, we've witnessed countless success stories. From New York City to Los Angeles and across the nation, we've seen how the right financing transforms restaurants. Our commitment extends to cities like Chicago, Philadelphia, Las Vegas, Houston, Boston, San Diego, Phoenix, San Antonio, San Francisco, Seattle, Dallas, Austin, Denver, Atlanta, Indianapolis, Washington, D.C., and Baltimore.

We understand that reliable equipment is the backbone of a great restaurant. Our wide selection of commercial pizza prep tables, restaurant equipment, and kitchen appliances is matched by financing options that make sense for your business.

Don't let financing challenges hold back your culinary vision. The tools you need are within reach.

Ready to take the next step? Explore our commercial kitchen equipment leasing options and find how easy it can be to get the equipment that will help your business thrive.