The Dish on Equipment Leasing: Pros, Cons, and Everything In Between

Share

Gearing Up Your Kitchen Without Breaking the Bank

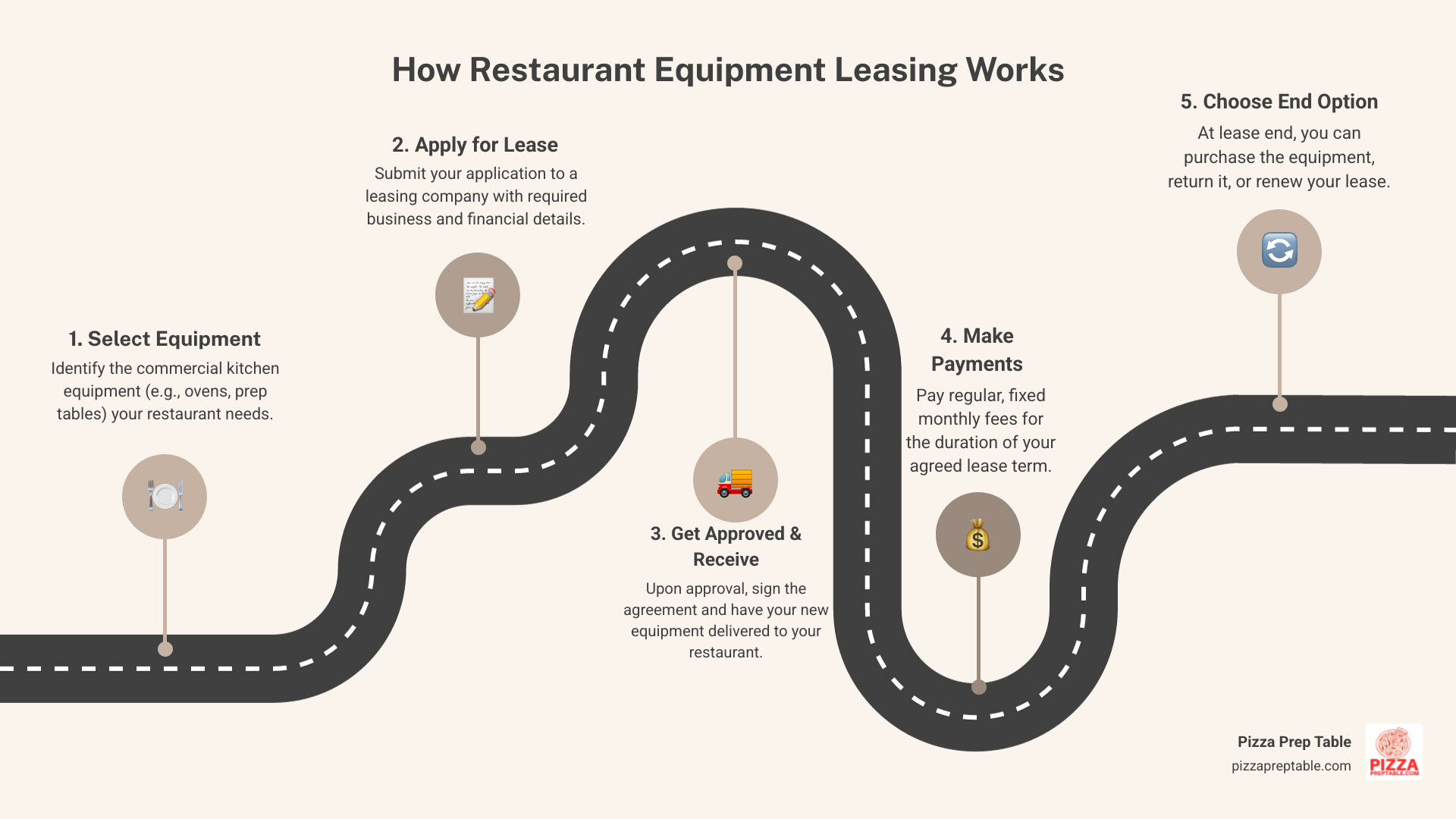

Equipment leasing restaurant financing is a flexible arrangement where restaurants pay monthly fees to use commercial kitchen equipment without purchasing it outright. Here's how it works:

- Monthly payments instead of large upfront costs

- Lease terms typically range from 12-60 months

- End-of-lease options include purchasing, returning, or renewing

- Types available include operating leases (renting) and finance leases (rent-to-own)

- Equipment covered ranges from pizza ovens to POS systems

Starting a restaurant is tough on your wallet. Seven out of 10 small restaurant owners begin with less than $20,000 in working capital - barely enough to cover the first month's rent, let alone outfit an entire commercial kitchen.

That new pizza oven you've been eyeing could cost $15,000 or more. Add in prep tables, refrigeration, and dishwashers, and you're looking at a six-figure investment before serving your first customer.

This is where equipment leasing comes in as a financial lifeline. Instead of draining your startup funds, leasing lets you spread costs over manageable monthly payments while preserving cash for marketing, inventory, and unexpected expenses.

In this guide, we'll break down everything you need to know about restaurant equipment leasing - from how it works to whether it's right for your business. We'll cover the pros and cons, walk through the application process, and help you make an informed decision.

What is Restaurant Equipment Leasing and How Does It Work?

Think of restaurant equipment leasing like renting a car, but for your kitchen. Instead of paying a huge chunk of cash upfront for that dream pizza oven or commercial refrigerator, you make smaller monthly payments to use the equipment. It's a partnership between you (the Lessee) and a leasing company (the Lessor) that owns the equipment.

The process is straightforward. You find the equipment you need, like one of our premium pizza prep tables, and apply to a leasing company. If approved, they purchase the equipment and let you use it for a monthly fee. Leasing bridges the gap for restaurant owners who need top-quality Commercial Kitchen Equipment but can't afford to pay for it all at once.

A sale-leaseback arrangement is another clever option. If you already own equipment but need cash, you can sell it to a leasing company and immediately lease it back. You get a cash injection while keeping the equipment that runs your business.

Types of Leases and Equipment

Not all leases are the same. Understanding your options can save you money and provide flexibility.

- Operating Lease: This is like renting. You use the equipment for a set period and return it at the end. It's great for technology that changes quickly, like POS systems.

- Finance Lease (or Capital Lease): This is more like a payment plan to own the equipment. It appears on your balance sheet, and you'll likely own it by the end of the term.

- $1 Buyout Lease: A popular choice where you can buy the equipment for just one dollar after all payments are made. It's a purchase plan that spreads out the cost.

- Fair Market Value (FMV) Lease: At the end of the term, you can buy the equipment at its current market value, return it, or renew the lease. This is ideal if you're unsure about long-term needs.

Almost any piece of restaurant equipment can be leased. For a complete list of what you might need, see our Commercial Kitchen Equipment Checklist. Common categories include:

- Cooking Equipment: Ranges, convection ovens, deep fryers, griddles, and specialty items like pizza ovens.

- Refrigeration: Walk-in coolers, freezers, reach-in units, and ice machines.

- Food Prep Stations: Stainless steel work tables, mixers, slicers, and dough sheeters.

- Dishwashing: High-capacity commercial dishwashers.

- Front-of-House: POS systems, security cameras, and even furniture.

The Great Debate: Leasing vs. Buying vs. Other Financing

Choosing how to finance your restaurant equipment depends on your cash flow, business goals, and long-term plans. Let's break down the key differences between restaurant equipment leasing options, buying, and other financing routes.

| Factor | Equipment Leasing | Buying Outright | Traditional Loans (e.g., Bank Loan) |

|---|---|---|---|

| Upfront Cost | Low (often first/last month's payment) | High (full purchase price) | Moderate (down payment required) |

| Monthly Payments | Fixed, predictable, often lower than loan payments | None (one-time payment) | Fixed or variable |

| Ownership | No ownership during term; option to buy at end | Immediate ownership | Ownership after loan is repaid |

| Maintenance | Typically lessee's responsibility | Owner's responsibility | Owner's responsibility |

| Tax Benefits | Payments often 100% deductible as operating expenses | Depreciation deductions; Section 179 | Only interest portion is deductible |

| Flexibility | Easy to upgrade; return equipment at end of term | Less flexible; selling can be time-consuming | Less flexible; tied to asset until paid off |

| Total Cost | Can be higher over time than buying | Lower total cost if kept long-term | Can be comparable to buying, plus interest |

The Pros: Why Leasing Might Be Your Secret Ingredient

Leasing offers several advantages that make it a popular choice for restaurant owners.

- Preserves Capital and Manages Cash Flow: Instead of a large upfront purchase, leasing spreads the cost into manageable monthly payments. This frees up capital for marketing, inventory, or emergencies, which is critical when seven out of 10 owners start with less than $20,000.

- Access to Better Equipment: Leasing makes top-tier, professional-grade equipment affordable from day one, giving your restaurant a competitive edge without draining your bank account.

- Easy Technology Upgrades: The restaurant industry evolves quickly. Leasing allows you to upgrade to newer, more efficient models without the hassle of selling old equipment.

- Predictable Budgeting and Tax Benefits: Leases come with fixed monthly payments, simplifying financial planning. Furthermore, lease payments are often fully deductible as an operating expense, which can offer significant tax savings. It's no wonder 80% of all U.S. companies use equipment leasing in some form.

The Cons: Potential Risks of Leasing

Leasing isn't without its downsides. Be aware of these potential pitfalls.

- Higher Total Cost: Over the full term, the total of your lease payments may be more than the equipment's purchase price.

- No Ownership Equity: Unless you have a buyout lease, you are not building equity in an asset.

- Contractual Obligations: Lease agreements are binding. Ending a lease early can result in significant penalties.

- Maintenance Responsibility: You are typically responsible for all maintenance and repairs, even though you don't own the equipment.

How Leasing Stacks Up Against Other Financing

- Bank Loans: Offer ownership and potentially lower interest rates but require down payments, collateral, and a lengthy approval process.

- Merchant Cash Advances: Provide very fast capital based on future sales but come with high costs, making them an expensive option for equipment.

- Business Lines of Credit: Offer flexibility for ongoing expenses but may have higher interest rates than dedicated equipment financing.

For new ventures, our guide on Restaurant Equipment Financing for Startups offers more custom advice.

The Ultimate Guide to Equipment Leasing Restaurant Agreements

Signing a restaurant equipment leasing contract is straightforward once you understand the key terms. A successful leasing experience depends on understanding the contract, choosing the right partner, and being aware of the legal details.

Understanding Typical Restaurant Equipment Leasing Terms and Conditions

Here's the language that matters most to your bottom line:

- Lease Duration: Typically runs from 12 to 60 months. Longer terms mean smaller monthly payments but a higher total cost.

- Payment Schedules: While monthly payments are standard, some companies offer seasonal schedules that align with your cash flow.

- Lease Factor: Instead of an interest rate, leasing companies use a lease factor to calculate your payment. It's just another way of expressing cost. To get your monthly payment, you multiply the equipment cost by the lease factor.

- End-of-Lease Options: When the term ends, you can usually purchase the equipment (for $1 or fair market value), return it and upgrade, or renew the lease, often at a reduced rate.

How to Choose the Right Leasing Provider

Picking a leasing partner is a critical decision. Look for a provider that acts as a true partner to your business.

- Reputation and Experience: Choose providers with a solid track record and positive reviews from other restaurant owners. A partner with experience in the foodservice industry will understand your unique challenges and offer more flexible terms.

- Transparency: A good provider will be upfront and clear about all rates, fees, and conditions. If they can't explain their terms in plain English, walk away.

- Customer Service: You want a provider who is responsive and helpful when you have questions or issues. Test their customer service before committing to a contract.

Key Legal Considerations for Restaurant Equipment Leasing Contracts

Understanding the legal basics can save you from major headaches.

- Read the Fine Print: Pay close attention to default clauses, which outline the consequences of missed payments or failing to meet other obligations, like maintaining the equipment.

- Insurance Requirements: Nearly all lease agreements require you to carry comprehensive insurance that covers the full replacement value of the equipment against loss, damage, or theft.

- Regional Laws: In Canada, the Personal Property Security Act (PPSA) governs how security interests in leased equipment are handled. Lessors register their interest under the PPSA to secure their legal right to the equipment in case of default. For example, under Ontario's PPSA, leases over one year must be registered. Understand the specific laws in your region.

Never sign a lease without understanding every clause. If needed, consult a business attorney for clarification.

The Application Process: How to Get Approved for a Lease

Getting approved for restaurant equipment leasing financing is often faster and more flexible than a traditional bank loan. The process is simple: select your equipment, submit an application, and upon approval, your equipment can be delivered within days.

Knowing what lenders look for can improve your chances of getting the best terms.

What Do Lenders Look For?

Leasing companies evaluate your reliability as a business partner. They focus on:

- Credit Score: Most lenders prefer a FICO score of 550 or higher, but many work with businesses that have less-than-perfect credit.

- Time in Business: Businesses operating for two years or more typically get better rates, but startups are still eligible.

- Business Plan: A strong business plan is crucial for startups. It should show realistic revenue projections and how the equipment will generate income. A good grasp of your Restaurant Startup Costs Breakdown demonstrates you've done your homework.

- Financial Statements: Lenders may review your income, balance sheets, and cash flow statements to assess your ability to make payments.

Given that 40% of businesses don't qualify for funding from traditional lenders, equipment leasing is a valuable alternative.

Leasing for Startups and Businesses with Bad Credit

Don't be discouraged by a new business or a low credit score. Many leasing companies specialize in these situations. Be prepared for higher rates to offset the lender's risk. You may also need to provide a personal guarantee or find a co-signer with strong credit.

A solid business plan is your best tool. If you plan to expand, showing your knowledge of topics like How to Start Catering Business can convince lenders of your growth potential.

Tax Implications of Leasing

The tax benefits of restaurant equipment leasing arrangements can be substantial.

In many cases, you can deduct your entire lease payment as an operating expense, which is often more advantageous than depreciating a purchased asset over several years.

For U.S. businesses, the Section 179 Deduction may allow you to deduct the full price of qualifying equipment in the year it's placed in service. For example, leasing $10,000 of equipment with a $1 buyout option could lead to a $10,000 deduction, potentially saving thousands in taxes.

Always consult with a qualified tax professional to understand how leasing affects your specific financial situation and to maximize your benefits.

Frequently Asked Questions about Restaurant Equipment Leasing

Here are quick answers to the most common questions we hear about restaurant equipment leasing financing.

Can I lease used restaurant equipment?

Yes, absolutely. Many leasing companies are happy to finance used equipment, which can significantly lower your monthly payments. The leasing company may require an independent inspection of the equipment before approval, and you should always check the warranty status, as it may be limited or non-existent.

What happens if the leased equipment breaks down?

Typically, you are responsible for all maintenance and repairs during the lease term. This should be clearly stated in your agreement. While the equipment isn't yours, keeping it in working order is your job. However, the manufacturer's warranty often transfers to you as the lessee, so be sure to keep all warranty documentation.

Can I include shipping and installation costs in my lease?

Yes, and it's a smart move. Most leasing companies offer "total financing," which allows you to bundle the equipment cost, sales tax, shipping, and installation fees into a single monthly payment. This simplifies your budgeting and preserves your cash by eliminating large, upfront ancillary costs.

Conclusion: Is Leasing the Right Ingredient for Your Restaurant?

So, is equipment leasing restaurant financing the right choice for your business? While there's no one-size-fits-all answer, leasing is a game-changer for many restaurant owners.

The primary benefits are clear: improved cash flow, access to top-tier equipment, and predictable payments. By preserving your working capital, you can invest in marketing, inventory, and growth. Leasing also allows you to stay competitive with the latest technology and may offer significant tax advantages.

However, leasing isn't for everyone. If you prioritize ownership or plan to use equipment for many years without upgrading, buying outright might be more cost-effective in the long run.

The key is to honestly assess your restaurant's unique needs and financial goals. Are you a startup trying to get off the ground? Leasing can help you launch without draining your bank account. Are you an established restaurant looking to expand? Leasing can be your ticket to growth.

At Pizza Prep Table, we've seen how the right financing strategy can transform a restaurant's trajectory. We don't just supply equipment; we help you figure out how to make it work within your budget.

The bottom line is that seeking financing is often the smartest move you can make. Restaurant equipment leasing has helped countless owners turn their culinary dreams into profitable realities.

Ready to explore what's possible for your kitchen? We're here to help you steer both equipment selection and financing.